ASTANA — A combination of a favorable business environment, robust banking infrastructure, supportive government policies, and fintech regulations, along with a tech-savvy population, makes Kazakhstan an attractive destination for foreign fintech investors and companies seeking growth opportunities, according to the report issued on April 13 by RISE Research, Kazakhstan’s MOST holding, and Fintech Consult international consulting company.

Photo credit: Forbes.com.

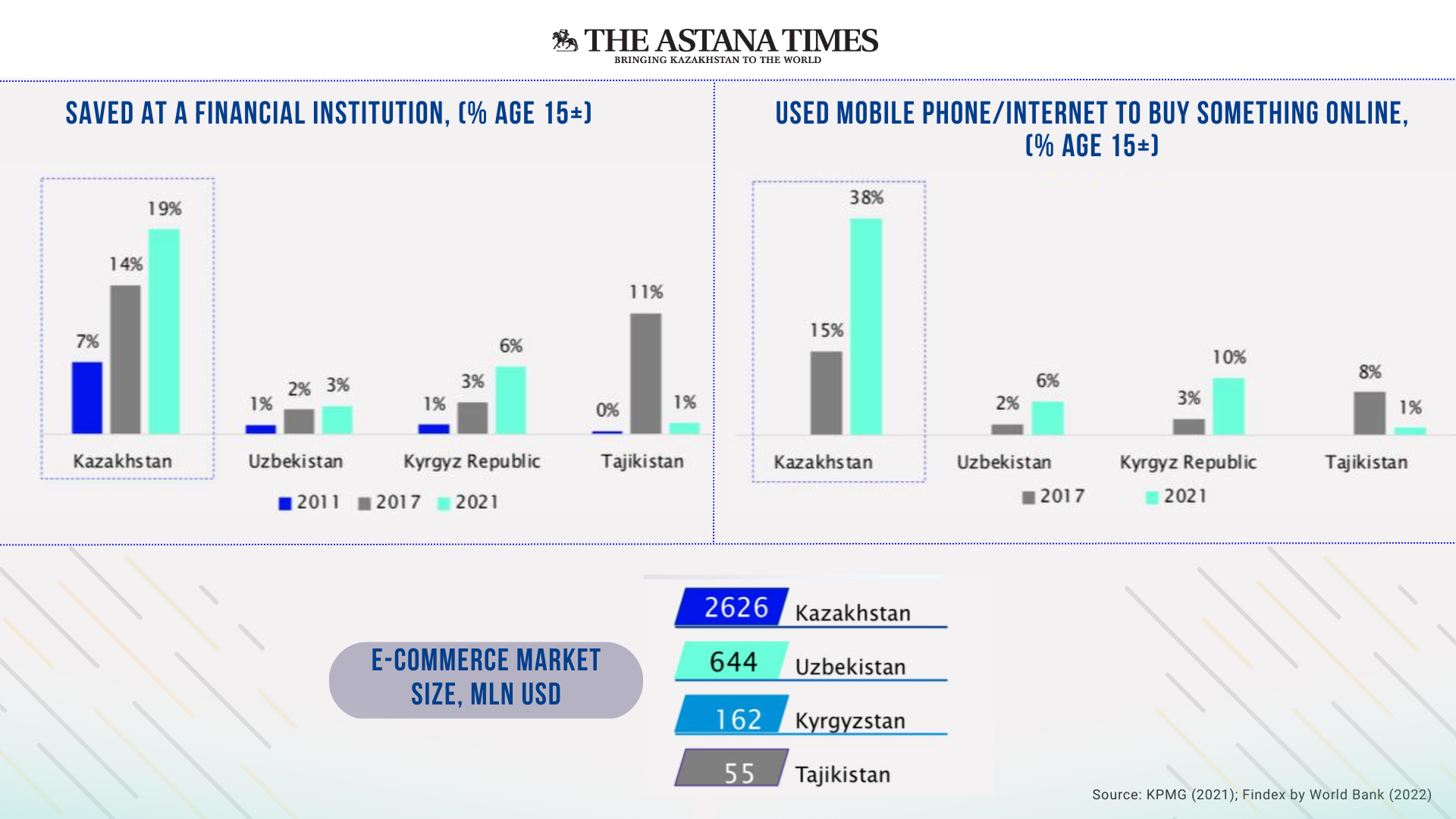

Among key trends identified by the report is the rise of digital payments and e-commerce, ecosystems, super-apps, digitization of small and medium-sized businesses (SMEs), the democratization of capital markets, and an increase in fintech companies.

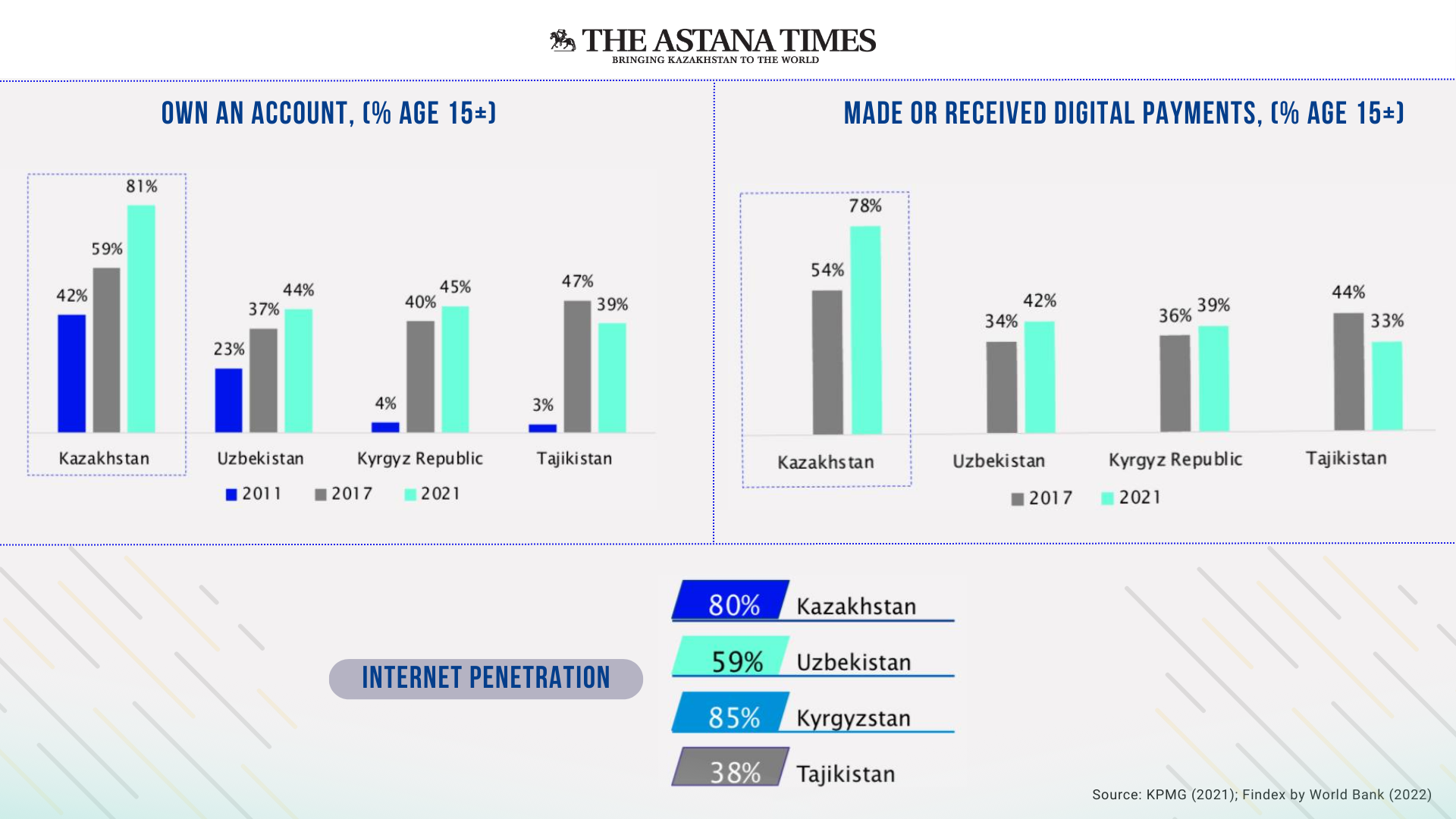

Kazakhstan’s leading position in improving financial inclusion and strong account and internet access are essential drivers of digital payment usage and prerequisites for favorable fintech development.

The country ranks first in the number of people who have a bank account, with 81 percent, followed by the Kyrgyz Republic and Uzbekistan, which have 45 percent and 44 percent, respectively. Comparing the usage of digital payments in Central Asia, Kazakhstan has a striking lead with 78 percent in 2021 compared to Uzbekistan with 42 percent and 39 percent in the Kyrgyz Republic.

The rise in digital payments and e-commerce

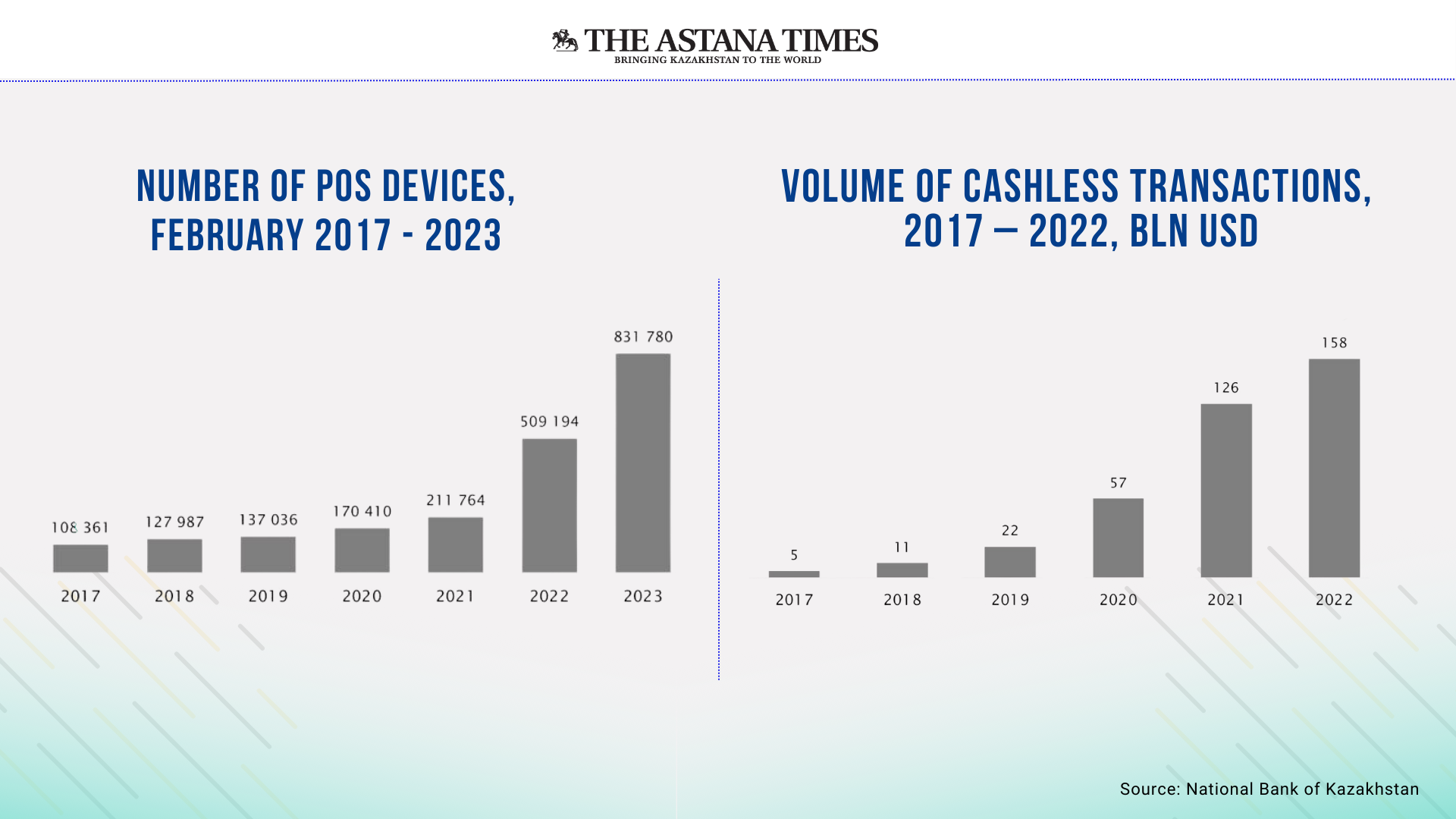

One of the main trends in the Kazakh fintech market is the rapid growth of digital payments and e-commerce. The volume of cashless transactions experienced a staggering growth from $5 billion in 2017 to $158 billion in 2022. Key technologies changing the payment landscape include biometrics, advanced data analytics, instant transfers, customer digital consent management, Open Banking, and Central Bank Digital Currencies (CBDC).

The popularity of new forms of payment, such as QR codes, among customers and merchants has led to an increase in cashless transactions. It is a convenient and low-cost way of making transactions. The report states that point-of-sale (POS) devices, which enable retailers to manage inventory and process sales, grew from 108,361 devices nationwide in February 2017 to 831,780 in February 2023.

The rise in the ecosystem and super-app adoption, which enable banks to offer customers a range of services through a single application, is another trend that changes daily life in a major way. According to the report, 86 percent of the population actively uses mobile banking services. These services combine financial and non-banking services, including online payments, mobile banking, e-commerce, investment, and insurance.

According to the report, the competition among banks to provide more services integrated into their ecosystems is intense, with Kaspi bank being a pioneer in this area since 2014. The bank is an example of a huge success – it has 11.2 million monthly active users in the country with a population of 19.7 million.

Banking application as an access point to government services

The trend of banking applications being used as access points to government services simplifies the process for citizens and benefits the banks and the government. The report notes that the banks increase transactional activity and cross-sales while the government gains access to banks’ distribution channels and digital services.

The report cites Kaspi.kz (Kaspi bank) and Homebank (HalykBank) banking applications as examples. Both offer access to multiple public services, such as tax payment, individual entrepreneur registration, and car sale and registration, considerably streamlining the process of receiving government services and saving people’s time.

An increasing number of SMEs also adopt digital payments, driving financial institutions to improve their credit scoring models using non-traditional data. It allows banks to make more informed decisions, reducing the risks of delayed loan payments. SMEs also obtain online services via banking applications for B2B transactions such as invoicing, accounting, charges, and HR and legal support.

The democratization of capital markets

The democratization of capital markets has become one of the key trends in the financial sector in recent years. According to the report, legislative changes adopted in 2020 have increased retail investors in the country.

“Second-tier banks are now authorized to offer brokerage services to individuals. Additionally, investment mobile apps have played a pivotal role in democratizing access to the stock market, making it more accessible to retail investors. Biometric identification services are now available for remote business relationships, and the need for traditional signature and identity card requirements has been removed,” reads the report.

The report underlines the Kazakh government’s policies toward developing a digital economy and innovations to accelerate the technological modernization of the economy in the past decade. The report shows that the country is firmly committed to developing the fintech industry by creating the necessary infrastructure and implementing digital reforms.

The rise of startups and investment opportunities

Another trend identified by the report is the increase in the number of startups. The report noted that instead of disrupting the financial sector, the startups are now shifting towards B2B partnerships, driving change and growth in the industry.

According to MOST Ventures Managing Partner Pavel Koktyshev, the success of established companies such as Kaspi and emerging startups such as OneVision has led to a surge in investments in the fintech industry.

“OneVision, a fintech company that offers a wide range of online payment services, was established in 2021 and has since expanded its operations to Kazakhstan, Azerbaijan, Uzbekistan, and Kyrgyzstan. The success of these businesses shows how homegrown startups have the potential to have a big market impact and create a healthy ecosystem. As more entrepreneurs create novel solutions, they strengthen the entire financial system and narrow the financial inclusion gap. Consequently, Kazakhstan is well-positioned to emerge as a regional hub for innovation and venture capital,” Koktyshev said.

As for the regulatory framework for investors, the report noted that Kazakhstan has a classic fintech stakeholder setup. However, it is unique in Central Asia because there are two different jurisdictions with two regulators.

The Astana International Financial Centre (AIFC), one of the fintech stakeholders with a different jurisdiction operating under English Law, has a holistic approach to developing the fintech ecosystem. The AIFC provides numerous benefits, including tax incentives on capital gains and dividends, a simplified registration process in English, and online applications.

“Kazakhstan’s fintech market stands out as the largest in Central Asia, with remarkable growth rates that place it among the fastest-growing fintech markets in Asia. This thriving industry owes its success to the government’s explicit support, notably through the AIFC,” said Fintech Consult Managing Partner Dr. Jochen Biedermann.