ASTANA– Kazakhstan continues to strengthen its position as Central Asia’s leading venture capital hub, securing $71 million in investments in 2024, which accounted for 74% of all regional deals, reported RISE Research, a market intelligence and advisory company.

Experts analyzed the region’s venture market based on data from over 200 startups and 40 investors.

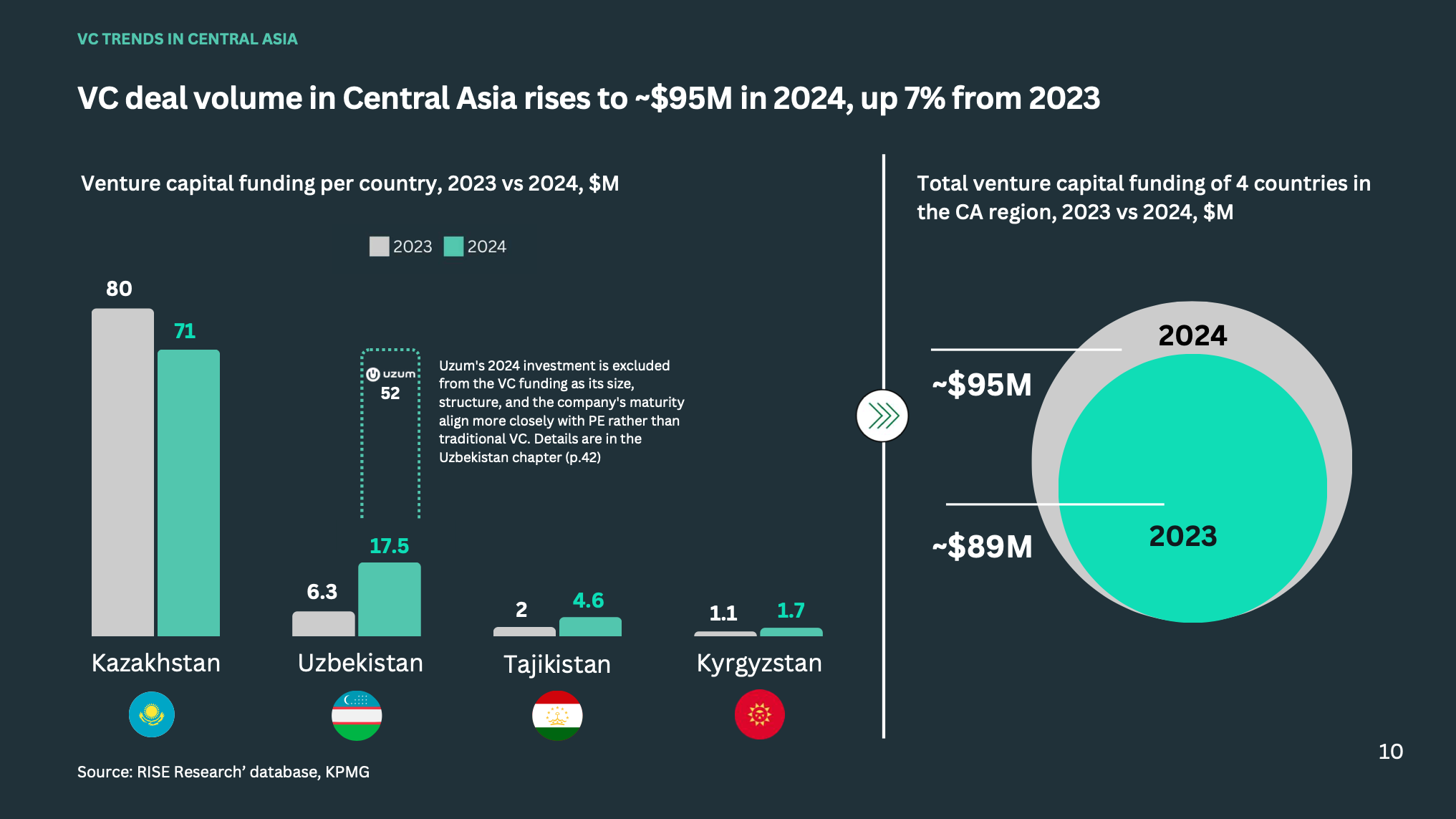

According to the report, Central Asia’s total volume of venture deals reached $95 million in 2024, a 7% increase from 2023. Kazakhstan remains the most dynamic player in the region, with an annual investment growth rate of 35% since 2018. The number of active investors in the country has tripled, exceeding 60, while over 80 venture deals were recorded throughout the year.

“The venture capital market in Central Asia, especially in Kazakhstan, is expanding rapidly. More startups are scaling internationally, and global investors recognize the region’s potential,” said Murat Abdrakhmanov, founder of MA7 Ventures.

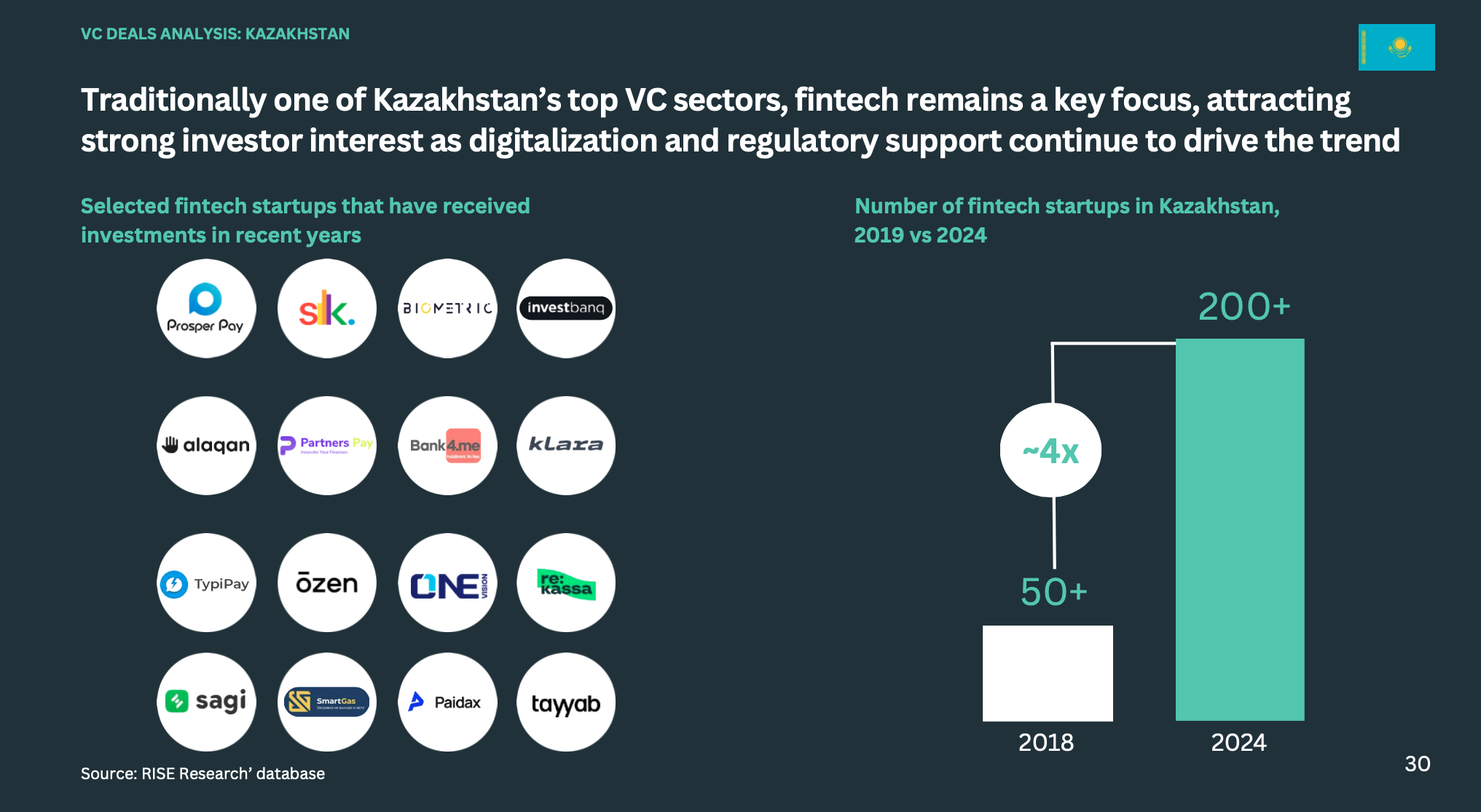

Key investment sectors include artificial intelligence (AI), HealthTech, and Enterprise Software. The real impact of AI on the market is even more significant than reported, as many startups integrate AI-driven solutions into finance, healthcare, and other industries.

The average deal size is increasing, reflecting an increase in the attractiveness of Kazakhstan’s startups to investors. Simple Agreements for Future Equity (SAFE) dominate early-stage (pre-seed and seed) investments, accounting for 63% of deals.

Kazakhstan’s 12 venture funds managed a total of $157 million in 2024, with 32% already invested in startups. Private investors (high-net-worth individuals) contribute 44% of venture capital, though upcoming government initiatives, including a fund-of-funds model, could significantly change funding sources in 2025.

Kazakhstan’s startups are increasingly expanding into global markets, including the United States, Europe, the Middle East, and Southeast Asia. These trends are driving higher investment valuations and deal sizes, positioning Kazakhstan for the emergence of its first unicorn startup.

The report was prepared in collaboration with EA Group, MA7 Ventures, BGlobal Ventures (a subsidiary of Qazaqstan Investment Corporation), KPMG, and Dealroom.co.