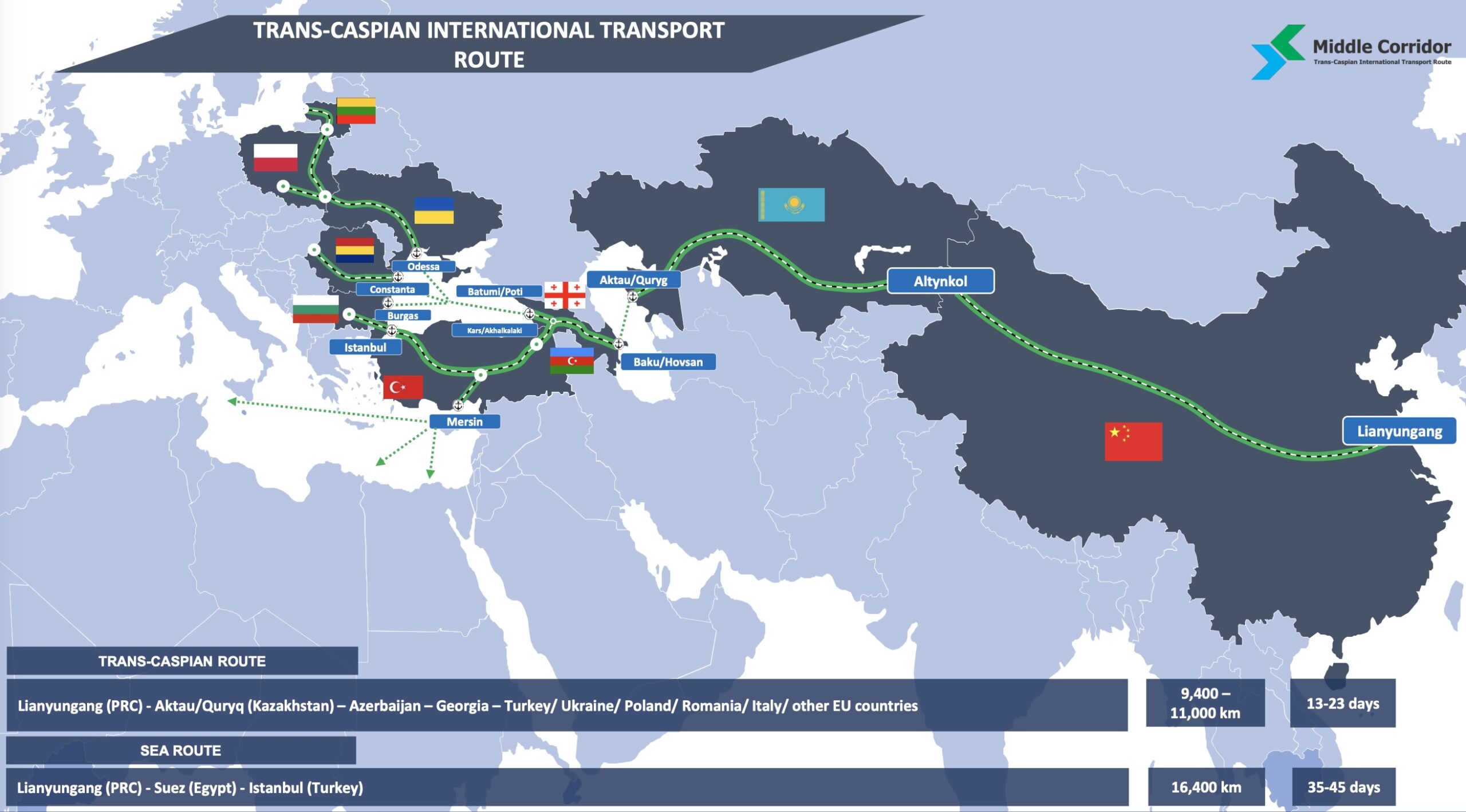

In the era of evolving trade dynamics, regional connectivity and geopolitical escalations, the emergence of the Middle Corridor has become a game changer in global commerce and trade. Also known as the Trans-Caspian International Transport Route (TITR), the Middle Corridor bridges the gap between China and Europe by running through Kazakhstan, Azerbaijan, and Georgia.

Following the Russia-Ukraine conflict, the traditional Northern Corridor involving Russia became less attractive. Consequently, the Middle Corridor emerged not merely as an option but as an imperative for the countries seeking to reduce geopolitical risk with stable trade routes. While maintaining a neutral stance in the Ukrainian crisis, Kazakhstan recognized the advantages of embracing the Middle Corridor for its potential to boost regional and global trade. In 2022, cargo shipments along the Middle Corridor reached nearly 1.5 million tons, while the Northern route saw a decline of 34% in shipping volume.

Middle Corridor. Photo credit: TITR

The Middle Corridor is the shortest multimodal trade route that utilizes a combination of rail, road, and sea transportation to connect China and Europe. Starting in China, the route passes through railway lines at Dostyk or Khorgos/Altynkol to the port of Aktau in Kazakhstan, then crosses the Caspian Sea to the port of Baku in Azerbaijan, and traverses Georgia before reaching European Union countries. The route is around 3,000 kilometers shorter than Russia’s Northern Corridor. This corridor not only decreases transit times between China and Europe from 19 days to 12 days but also addresses sanctions-compliance issues by bypassing Russia.

Muhammad Rafiq.

A trilateral agreement was signed between Kazakhstan, Azerbaijan, and Georgia in 2023 to establish a joint logistics company that enhances the potential of the Middle Corridor. Subsequently, they registered a single transport operator Middle Corridor Multimodal at the Astana International Financial Center (AIFC). This operator is expected to commence official operations by the end of 2024, with Türkiye potentially joining by early 2025. This joint venture aims to eliminate operational obstacles that hinder the flow of goods along this route by streamlining cargo regulations, standardizing tariffs, and simplifying custom procedures.

Significant infrastructure development is underway to realize the full potential of the TITR. China has agreed to operate a 10-container train every month across the Middle Corridor. In January this year, the EU announced an investment of 10 billion euros (US$10.75 billion) in the development of logistics and transport projects in Kazakhstan and other Central Asian states. This initial investment will be followed by an additional investment of 18.5 billion euros (US$19.9 billion) to streamline the highways, railways, and seaports of Aktau and Kuryk, ensuring seamless delivery of goods from China to Europe.

In August 2023, the Kazakh company PTC Holding began constructing a multimodal terminal Poti Transterminal at Poti, a key Georgian port on the Middle Corridor. This terminal will have a handling capacity of 80,000 twenty-foot containers annually. Another significant development is the reopening of the Baku-Tbilisi-Kars railway (829 kilometers) after modernization and completion work. This railway is vital for the Middle Corridor as it connects Türkiye with Central Asia and China through Georgia and Azerbaijan. Experts from the World Bank believe that by 2030, the Middle Corridor will have the capacity to handle 10-11 million tons of cargo annually. Kazakhstan’s contribution will be essential, serving as a transit hub and a key exporter to the EU of goods and materials from its mining and agricultural industries.

The World Bank is optimistic that the Middle Corridor can serve as an engine of growth, boosting trade, creating jobs, and spurring entrepreneurship. To reduce travel time along the corridor by half and triple trade flows by 2030, the World Bank has proposed the following measures:

a) An urban railway bypass should be created around the city of Almaty to reduce congestion in the Almaty metro area for freight trains.

b) In order to eliminate the long wait time at the Uzbekistan-Kazakhstan border, a new railway connection between Uzbekistan and Kazakhstan should be created.

c) Port operations at Aktau must be enhanced with most efficient cranes for each cargo type and rail-mounted equipment to increase operational efficiency.

d) The capacity and efficiency of the Middle Corridor as a transit route for freight can be improved by increasing the rolling stock (locomotives, railway vehicles), particularly in Georgia.

e) A dual gauge railway track should be constructed at the Akhalkalaki-Türkiye border (Georgia) to ensure operational efficiency, in addition to the development of a multimodal container terminal or marshaling yard.

f) The maritime capacity of the Poti Port of Georgia must be restored and its hinterland rail connectivity needs to be upgraded to accommodate more container vehicles and reduce container transit time.

g) Another urgent bottleneck that needs to be addressed is the modernization of the Sivas-Kars-Georgia border railway line, which currently has limited cargo carrying capacity and suffers from technical obsolescence.

h) Build an above ground railway link across the Bosporus via Istanbul’s Third Bridge to enhance the competitiveness of the Middle Corridor’s Türkiye section.

i) Investments to improve port and rail connectivity in Romania and Bulgaria can reinforce the cross-border linkage of the Middle Corridor with Central Europe.

j) Other recommended measures include digitization of customs and efficient border management, prompt information exchange, and standard turnaround time for service delivery.

Moreover, there are natural avenues for expanding the Middle Corridor, not only to South Asia but also to provide the shortest access to warm waters for marine trade. Both Pakistan and Kazakhstan are part of the Chinese Belt and Road Initiative (BRI) that comprises six corridors. Among these, the following three corridors pass through Pakistan and Kazakhstan:

1. China Pakistan Economic Corridor (CPEC): This corridor stretches approximately 3,000 kilometers from Kashgar in Xinjiang, the western province of China, to the Gowadar sea port in Pakistan’s Balochistan Province. The government of Pakistan has deployed the Frontier Works Organization (FWO) to keep the Karakoram Highway between Sost and Khunjerab (86 kilometers) open even in winter, facilitating international transit and trade.

2. New Eurasian Land-Bridge Corridor (NELB): This corridor connects China to Europe by crossing Kazakhstan at Dostyk, Mointy, Astana, and Petropavl on Route-1; and Altynkol, Almaty, Shu, Zharyk, Zhezqazghan, Saksaulskaya, Shalkar, Beyneu, and Aktau on Route-2.

3. China-Central Asia-West Asia Economic Corridor (CCAWEC): This corridor connects China to Iran/West Asia and passes through Kazakh railway stations of Altynkol and Almaty.

Interestingly, all three corridors have connections with Xinjiang. By linking Kashgar, the culminating point of CPEC, to Altynkol (Khorgos), the joint connection of NELB and CCAWEC, all three BRI corridors would be connected to the Middle Corridor, which is already linked with Khorgos. This BRI and Middle Corridor axis would significantly expand global trade options for all the participating countries, enabling the inter-flow of global trade from North to South and South to the North.

Kazakhstan is the linchpin in the development and success of the Middle Corridor, aligning with its goal to become a transport and logistics hub. According to the TITR International Associations, the transportation volume of the Middle Corridor reached 771 million tons in the first quarter of 2024, up from just 1.7 million tons in 2022. Thus, the Middle Corridor is poised to make a significant impact on global trade, potentially reshaping the geopolitical and economic landscape of the world. However, this requires concerted efforts from all stakeholders, including national governments, private investors, and regional and international bodies.

Muhammad Rafiq (Pakistan) is a senior banker based in Kazakhstan with an interest in Central Asian studies.

Disclaimer: The views and opinions expressed in this article are those of the author and do not necessarily reflect the position of The Astana Times.