ASTANA – The final decision on the Digital Tenge project has not yet been made, but is expected to be announced by the end of 2022, the project’s head Ainur Kenzhayeva said in an interview with The Astana Times.

Ainur Kenzhayeva leads the Digital Tenge project.

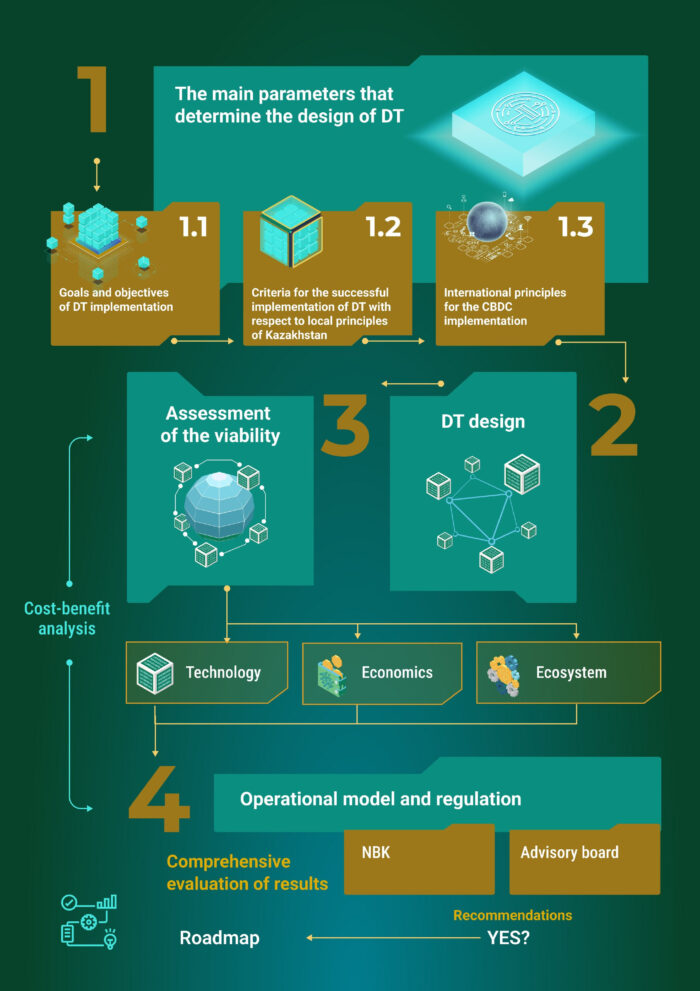

The project, which the National Bank of Kazakhstan has been working on with financial market participants, the expert community, and international partners since 2021, requires a comprehensive analysis and study of all potential benefits and risks for business participants, as well as in terms of monetary policy and financial stability.

“This year, we are working with the market participants to expand the technological prototype of the platform and conduct quantitative, economic research, and assessment of regulatory aspects. All stakeholders are invited to participate in this work,” said Kenzhayeva.

The team is working now to expand the platform’s functionality. A pilot project with the participation of real users in a limited loop is also planned for this fall.

What is the Digital Tenge?

Over the past few years, Kazakhstan has seen a tremendous increase in the use of digital technologies, largely driven by the pandemic. In their 2021 report, the Association of Financiers of Kazakhstan indicate that the volume of non-cash transactions in 2021 reached a staggering 72.3 trillion tenge (US$154.3 billion) and 19.1 trillion tenge (US$40.8 billion) in the first quarter of 2022.

In the middle of a rapid transformation from a cash to a cashless society, Kenzhayeva noted the growing demand for the security of the payment infrastructure.

“Central bank digital currencies can solve current challenges by increasing security and neutrality in new digital payments, financial inclusion, innovation, and system openness. Central banks exist to protect a country’s monetary and financial stability. They are a tool to achieve these goals,” she said.

Kazakhstan, in fact, is not the first country to consider introducing a digital currency. According to the Atlantic Council tracker, at least 112 countries around the world are at varying stages of exploring or launching a digital currency.

Kenzhayeva explained that digital currency is a “necessity of the time.”

“The digital tenge project aims to develop and modernize Kazakhstan’s national payment system to provide stable access to inexpensive, fast, convenient, and secure payments for every citizen. The introduction of digital tenge is a requirement of the times: during the pandemic, the development of non-banking platforms accelerated and the potential risks of the impact of private projects on the country’s monetary sovereignty increased,” she said.

She also noted that the digital tenge is designed to expand financial inclusion and to democratize access to the digital payment ecosystem.

“Kazakhstan has a high proportion of the population that have either no or little access to banking services. As an alternative to cash, the digital tenge will provide a safe and convenient way to store and use money, while providing access to modern financial services,” she said.

How does it work?

Technologically, the digital tenge pilot functions on an open-source distributed registry platform.

“This approach provides an opportunity to issue digital tenge in the format of so-called tokens. Tokens will be stored in the digital wallets of consumers, which they can access through the channels of financial market participants, like second-tier banks, and payment organizations,” said Kenzhayeva.

Consumers will be able to pay with digital tokens by analogy with the current means of payment through contactless cards or QR codes. They will also be able to pay without an internet connection.

If launched, digital currency will be used along with cash or non-cash money. It will be issued only by the National Bank of Kazakhstan, which provides a guarantee that the money is protected.

“By comparison, electronic money is issued and traded within a particular e-money system and is the obligation of the owner of the system, while stablecoins and cryptocurrencies, while similar in their technological approaches, cannot perform all the functions of money as a means of circulation, accumulation, and payment, as well as a measure of value. They lack a single issuer that could guarantee the protection of holders’ interests, and their value is subject to fluctuations,” said Kenzhayeva.

What are the risks?

Speaking of risks, Kenzhayeva noted the so-called “digital escape,” implying the risks of the outflow of funds from commercial banks due to the potential advantages of digital currency. “The advantages are the possibility of interest accrual, a high level of liquidity due to the feasibility of payments in offline mode, without access to the internet, and the security of assets by the National Bank, not second-tier banks,” said Kenzhayeva.

Potential risks and advantages will become more evident, once the macro and microeconomic studies of the impact of the digital tenge on the country’s economy and financial stability will be completed.