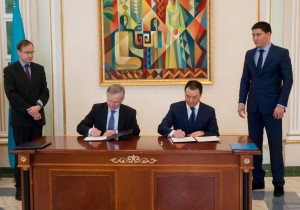

ASTANA – The Ministry of Foreign Affairs hosted a signing ceremony Feb. 18 to celebrate the first loan agreements between the European Investment Bank (EIB) and the Development Bank of Kazakhstan (DBK) and between EIB and a Kazakhstan subsidiary of Russia’s Sberbank. In total, 120 million euros are to be given by EIB to DBK and another 100 million euros to Sberbank in Kazakhstan.

ASTANA – The Ministry of Foreign Affairs hosted a signing ceremony Feb. 18 to celebrate the first loan agreements between the European Investment Bank (EIB) and the Development Bank of Kazakhstan (DBK) and between EIB and a Kazakhstan subsidiary of Russia’s Sberbank. In total, 120 million euros are to be given by EIB to DBK and another 100 million euros to Sberbank in Kazakhstan.

The Brussels-based EIB is the European Union’s long-term lending institution and is owned by its member states. It makes long-term financing available for investments that help fulfil EU policy goals. The two EIB loans are aimed at Kazakhstan’s small- and medium-sized enterprises (SMEs) as well as the country’s midcap companies. Most of these companies are involved in environmental protection and countering climate change.

Following the signing ceremony, Minister of Foreign Affairs of Kazakhstan Erlan Idrissov noted that cooperation with the EIB is new to Kazakhstan’s investment policies and to the State Programme for Accelerated Industrial and Innovative Development (SPAIID).

“We attach great importance to the development of mutually beneficial cooperation and fruitful dialogue with the EIB. The foreign ministry makes every effort to fulfill the President’s orders to attract foreign investment,” the Kazakh minister said.

EIB Vice-President for Kazakhstan lending operations Wilhelm Molterer said that EIB will foster private sector development by improving SME and midcap company access to long-term financing. These loans will assist projects that increase the diversity of the Kazakh economy.

“At the same time, EIB funds will facilitate the Kazakhstan 2050 Strategy, which aims to develop a sustainable and efficient economic model capable of propelling Kazakhstan into the 30 most developed countries in the world,” Molterer noted.

Funds provided by the EIB will contribute to increasing the share of GDP generated by small and medium-sized enterprises, which is currently 18 percent. In Kazakhstan, SMEs employ some 2.5 million people or 28 percent of the workforce.

These loans help fulfil the objectives of the EIB External Lending Mandate, which is focused on the development of the local private sector, as well as social and economic institutions. Entities focused on climate change mitigation and adaptation are also targeted by the loan programme. In keeping with these objectives, half of all loans will be dedicated to financing climate change management and climate adaptation projects found eligible for funding under the EIB Climate Change Mandate.

Participants of the signing ceremony also included acting chairman of DBK Askar Dostiyarov and Deputy Chairman of the subsidiary bank of Russia’s Sberbank Eldar Tenizbayev.

Minister of Economy and Budget Planning Yerbolat Dossayev met with Wilhelm Molterer on the same day telling him Kazakhstan views its cooperation with EIB as an important element of the comprehensive development of ties with the European Union, the country’s largest trade and economic partner. Dossayev added such cooperation will stimulate foreign investment and business activities in Kazakhstan.

The current loan agreements come on top of the Framework Agreement between Kazakhstan and EIB that was signed in Brussels in April 2010 and entered into force in April 2011, and a memorandum of understanding between the Samruk Kazyna National Welfare Fund and the Development Bank of Kazakhstan on the one hand and the EIB on the other, providing for EIB to invest up to 300 million euros in projects in Kazakhstan.