ASTANA – Projections for Kazakhstan’s rare earth metal reserves are estimated at 2.6 million tons, the Geology Committee of the Kazakh Ministry of Industry and Construction told The Astana Times in a written comment.

Demand for critical minerals is growing, but IEA warns of risks of supply disruptions amid the concentration of supply in a handful of countries and rising export restrictions. Photo credit: IEAE

According to government data, the production of rare and rare earth metals accounts for 2.4% of Kazakhstan’s metallurgy sector.

In 2024, the total area of geological and geophysical exploration coverage across the country expanded from 1.91 million to 2.014 million square kilometers. To put that in perspective, Kazakhstan’s territory spans 2.7 million square kilometers.

Top three producers 2030. Photo credit: IEA

“As a result of the work carried out, 38 sites with potential for solid minerals [rare earth elements, non-ferrous and precious metals] and hydrocarbons were identified. Estimated reserves include 2.6 million tons of rare earth elements, 23,800 tons of beryllium, 1.1 billion tons of brown coal, 3.7 million tons of copper and nickel, 19 tons of gold, 2 million tons of zirconium, 0.5 million tons of niobium, and 0.4 million tons of tungsten,” the committee said in a written comment for this story.

Significant prospects for rare earth metals have been identified at the Kuirektykol site in the Karagandy Region, with reserves of approximately 800,000 tons. According to the committee, this is sufficient for industrial development and could be doubled through further exploration of the site.

Unified platform

The committee noted that a unified subsoil use platform was put into commercial operation in June 2023, following the directive from the country’s leadership on the digitalization of the subsoil use sector.

“To date, the platform has been modified, and 22 government services have been launched since Jan. 1 of this year. More than 1,300 applications for subsoil use rights have been reviewed. A total of 1,047 licenses for the exploration of solid minerals and 19 licenses for extraction have been issued electronically. Thirty-five contracts and 3,331 licenses for subsoil use for solid minerals have been digitized, as well as 1,212 contracts for subsoil use for commonly occurring minerals,” the committee said.

As of January 2025, the platform had more than 60,000 electronic versions of geological reports. This provides an opportunity to become familiar with the general part of the required report online, free of charge, and without physically visiting geological archives.

Government priority

At an Aug. 21 meeting focused on the development of the rare and rare earth metals industry, Prime Minister Olzhas Bektenov emphasized the need to modernize existing production facilities and infrastructure, expand geological exploration, introduce modern processing technologies, and develop the research base.

The nation has invested 67 billion tenge (US$124.2 million) in the industry since 2018.

Global outlook on critical minerals

As the world transitions to clean technology, demand for critical minerals is increasing. The latest Global Critical Minerals Outlook by the International Energy Agency (IEA) indicates that the demand for key energy minerals continued to “grow strongly” in 2024.

“Lithium demand rose by nearly 30%, significantly exceeding the 10% annual growth rate seen in the 2010s. Demand for nickel, cobalt, graphite and rare earths increased by 6‑8% in 2024,” reads the report.

Rare earths are strategically critical components of electronics and clean energy technology. Kazakhstan aims to foster closer cooperation with international partners in exploring the numerous opportunities these deposits offer.

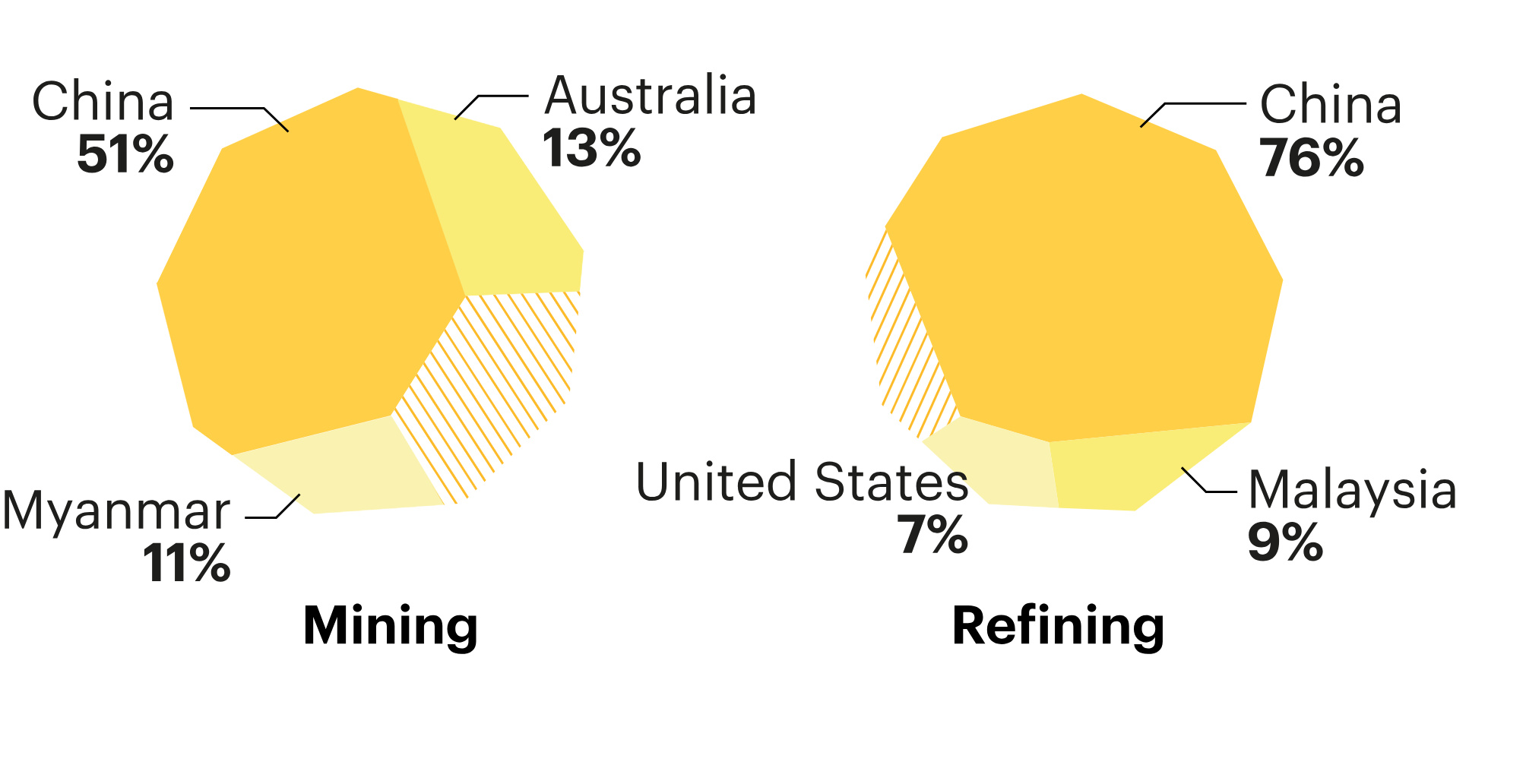

“Global collaboration remains essential to diversifying supply sources, linking resource-rich countries with those possessing refining capabilities and downstream consumers. Major opportunities exist for cross-border partnerships and collaboration in highly concentrated supply chains,” reads the report.

The report warns that the concentration of supply in a few countries and the rising export restrictions increase the risk of “painful disruptions.”