The Asian Development Bank (ADB) expects the economic growth in Central Asia to drop to 2.8 percent in 2020, citing COVID-19, lower petroleum prices, and stagnation in production among its list of reasons in its recent Asian Development Outlook (ADO) 2020. But the regional economies are expected to pick back up with growth returning to 4.2 percent in 2021 once the situation is normalized.

“The unfolding of the global pandemic—and thus the outlook for the global and regional economy—is highly uncertain. Growth could turn out lower, and the recovery slower, than we are currently forecasting. For this reason, strong and coordinated efforts are needed to contain the COVID-19 pandemic and minimize its economic impact, especially on the most vulnerable,” said ADB Chief Economist Yasuyuki Sawada.

Photo credit: the Asian Development Bank.

Central Asia reached a staggering 4.9 percent growth rate last year.

“Growth in the subregion will drop to 2.8 percent in 2020 as economies falter worldwide and drag down global commodity prices,” said the report.

Lower petroleum prices will affect the region’s biggest oil exporters, including Azerbaijan, where growth is expected to slow down to 0.5 percent, and Kazakhstan, the region’s largest economy, where growth is forecast to go down to 1.8 percent. The situation may worsen with the cuts to public investment spending.

“Fiscal consolidation and lower remittances from the Russian Federation will weaken growth in Tajikistan. Georgia’s highly tourism and trade-dependent economy will be particularly vulnerable to COVID-19 as closed borders and monetary tightening grind growth to a halt in 2020. Growth in Armenia, a metal producer notable for its sales to China, will fall sharply this year, and slower mineral exports to China will slow growth less dramatically in the Kyrgyz Republic and Uzbekistan,” said the report.

Inflation in the region is projected to reach 7.6 percent.

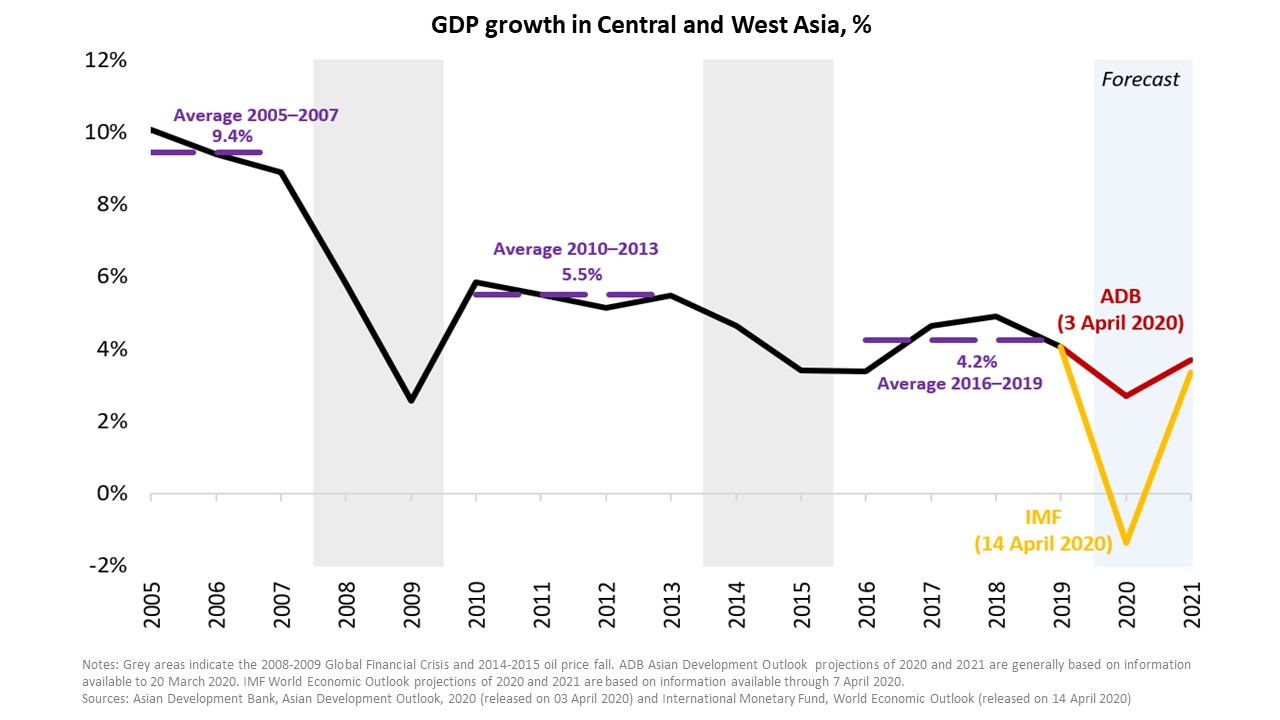

As the pandemic continues to affect economies worldwide, ADB experts say the economic downturn will be unprecedented and worse than the 2008–2009 global financial crisis or the 2014–2015 fall of oil prices.

ADB experts stress the need for “bold action.”

“The region now needs to cope with expected disruptions in global and regional linkages affecting supply chains, tourism, remittances, and financial flows. At the same time, domestic outputs are expected to decline due to containment measures. On top of this, oil exporters have to deal with the sharp decline in oil prices,” said the bank, noting that the pandemic could leave permanent scars.

The bank recommends central banks provide greater liquidity to the markets in an effort to support easier access to credit.

“A timely fiscal stimulus is critical to ensure that doctors are paid and personal protective equipment is provided, but also to support businesses, preserve jobs and to expand social protection,” it said.

It commended the announcement of fiscal packages in Kyrgyzstan and Kazakhstan, but cautioned the governments to “reprioritize public spending, utilize existing fiscal buffers, seek grant or debt financing, and to find new ways of engaging the private sector in the relief and recovery effort.”

The recovery plan will need to revise a new balance between the state and the private sector, giving the latter more freedom to contribute to the economy and lead the reforms.

“After the storm has passed, governments will, of course, need to restore fiscal space and reduce debt vulnerabilities. They will also need to renew their commitment to reforms, to enable a strong and sustained private sector-led recovery. The COVID-19 crisis has demonstrated the critical importance of efficiency in public management and inclusiveness of social safety nets to ensure resilience against disasters,” said the bank.