ASTANA –The spring 2015 edition of the biannual Kazakhstan Economic Update of the World Bank titled “Kazakhstan – Low Oil Prices; an Opportunity to Reform” forecasts a positive economic scenario for the country in coming years, despite external shocks and lowered demand domestically.

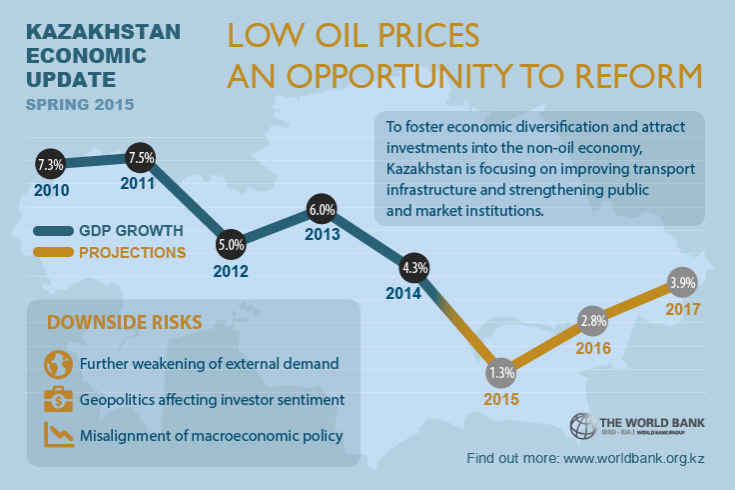

Kazakhstan’s GDP growth slowed from 6 percent per year in 2013 to 4.3 percent in 2014 due to weak demand from China and Russia, main trade partners for Kazakhstan’s metals and metal products, and because of slackening domestic demand after the tenge was devalued in February 2014. During the second half 2014, oil prices plummeted by about 50 percent internationally, affecting not only export and fiscal revenues but also investor confidence in the Kazakh economy.

The report predicts GDP growth in 2015 will be as low as 1.5 percent, the lowest since 2009. However, the next year could see some recovery with a growth of 2.8 percent, while in 2017 the economy could expand at a more solid rate of 3.9.

To attract and retain investment, Kazakhstan’s authorities are establishing systematic procedures to ensure the quality of both new and existing regulations, such as expanding the mandate of the Interdepartmental Commission for Regulation and setting out obligations for the systematic use of Regulatory Impact Assessments (RIAs) when new regulations are proposed. In addition, the Kazakh government is setting up a system to prevent investor-government disputes by appointing the institution “Investment Ombudsman.”

Notably, the authorities are moving ahead with their ambitious agenda of regulatory and institutional reforms to diversify the economy and increase private sector participation, including a plan for 2014-16 to privatise a portion of state-owned enterprises (SOEs), which was announced by President Nursultan Nazarbayev in April 2014. Furthermore, the government is also expected to sell its interests in 32 smaller companies to strategic investors through auction. Therefore, implementation of the plan and streamlining regulations consequently will lead to improvement of the business environment of the country.

Trade, transport, and real estate services were the main supports for economic growth in 2014. Notably, official unemployment declined from 5.2 percent of the total force in 2013 to 5.0 percent in 2014 due to job creation in the services sectors. Since 2006, a large share of the population has escaped poverty, and “further poverty reduction is expected” according to the World Bank.

There is no doubt that after the February 2014 devaluation (the tenge was devalued by 19 percent against the U.S. dollar), tighter monetary policy has led to lower credit growth, raised the cost of borrowing and affected domestic demand. In order to manage the pressure on the tenge the authorities together with tighter monetary policy have combined a modest fiscal expansion.

The World Bank welcomed two economic support packages launched in 2014, which have been mitigated by simultaneous budget cuts in other areas. The 2015 national budget was cut by $3.3 billion, pared down by deferring non-priority investment expenditures and delaying increases in public salaries until Jan. 1, 2016, the report informs. Notably, budget cuts were partially offset by additional $1.9 billion disbursements from the National Fund for the Nurly Zhol (Path to the Future) programme, a major governmental infrastructure investment programme announced by President Nazarbayev in his state-of-the-nation address in November 2014.

The World Bank update claims, assuming relatively stable external conditions in the near term, that the Nurly Zhol programme is expected to have a positive effect on employment, though its impact on GDP growth is likely to be marginal due to the budget cuts.

During the fiscal adjustment, the government protected pensions and social assistance obligations from sequester; while some non-priority capital spending in the social area, especially education, was delayed until next year.

Regarding the update’s projections, if oil prices start to recover to $57 in 2016 and $61, export earnings and domestic demand would gradually recover, allowing growth to reach 2.8 percent in 2016 and 3.9 percent in 2017. It has been predicted that oil production will remain almost flat until the end of 2017, when the offshore Kashagan oil field is expected to come on line and boost production. Moreover, “the economic support programmes may stimulate GDP growth for 2016 and onward; to avoid procyclical fiscal expenditures, the authorities have committed to eliminate them if the economy is recovering well,” the report pointed out. As a result, assuming non-oil revenues rise as the economy starts to recover, the non-oil deficit is projected to decline gradually from 10.8 percent of GDP in 2014 to 8.8 percent in 2017.

In terms of financial and monetary stability, in the medium term, authorities intend to move to establish inflation rate targeting and a more flexible exchange rate regime. Therefore, a more neutral monetary policy stance in addition to a floating exchange rate regime would more sustainably support growth.