ASTANA – Kazakhstan’s foreign trade turnover reached $139.8 billion in 2023, an increase of 3.2% compared to the previous year. China has become the country’s largest trade partner with bilateral trade hitting $31.5 billion, replacing Russia, according to the latest data from the Bureau of National Statistics.

Photo credit: Kazakh Ministry of National Economy.

The nation has expanded its commercial horizons by solidifying its trade relations with traditional partners but also venturing into new markets and diversifying its export portfolio, a consequence of President Kassym-Jomart Tokayev’s packed diplomatic visits last year.

Kazakhstan, the largest economy in Central Asia, currently sends products to 135 countries. The number of commodity items grew from 3,754 in 2022 to 3,857 in 2023.

Out of $139.8 billion, exports reached $78.7 billion, down by 7% compared to 2022, and imports made $61.2 billion, witnessing a nearly 20% increase.

Photo credit: The Astana Times

Yernar Serik, director of the Center for Trade Policy Development at the Economic Research Institute, explains that the decrease in exports is due to the volatility in global prices for hydrocarbons, which remain the nation’s key exports.

“Undoubtedly, Kazakhstan’s economy, heavily dependent on the export of raw materials, especially oil and metals, feels the direct impact of global price fluctuations for these resources. For instance, according to World Bank statistics, the average price of Brent crude oil in 2022 was $100 per barrel, while in 2023, the average annual price dropped to $83 per barrel,” he told The Astana Times.

The surge in imports can be attributed to an increase in investment activities within the country, including the implementation of major investment and infrastructure projects and an increase in domestic consumption spurred by the dynamic development of the e-commerce market.

“By the year’s end, investments in fixed capital grew by 14%, reaching 18 trillion tenge (US$39.9 billion), while the e-commerce market was predicted to grow to $5 billion by the end of the year, accounting for 12.5% of the total volume of retail trade,” said Serik.

China becomes a key trade partner

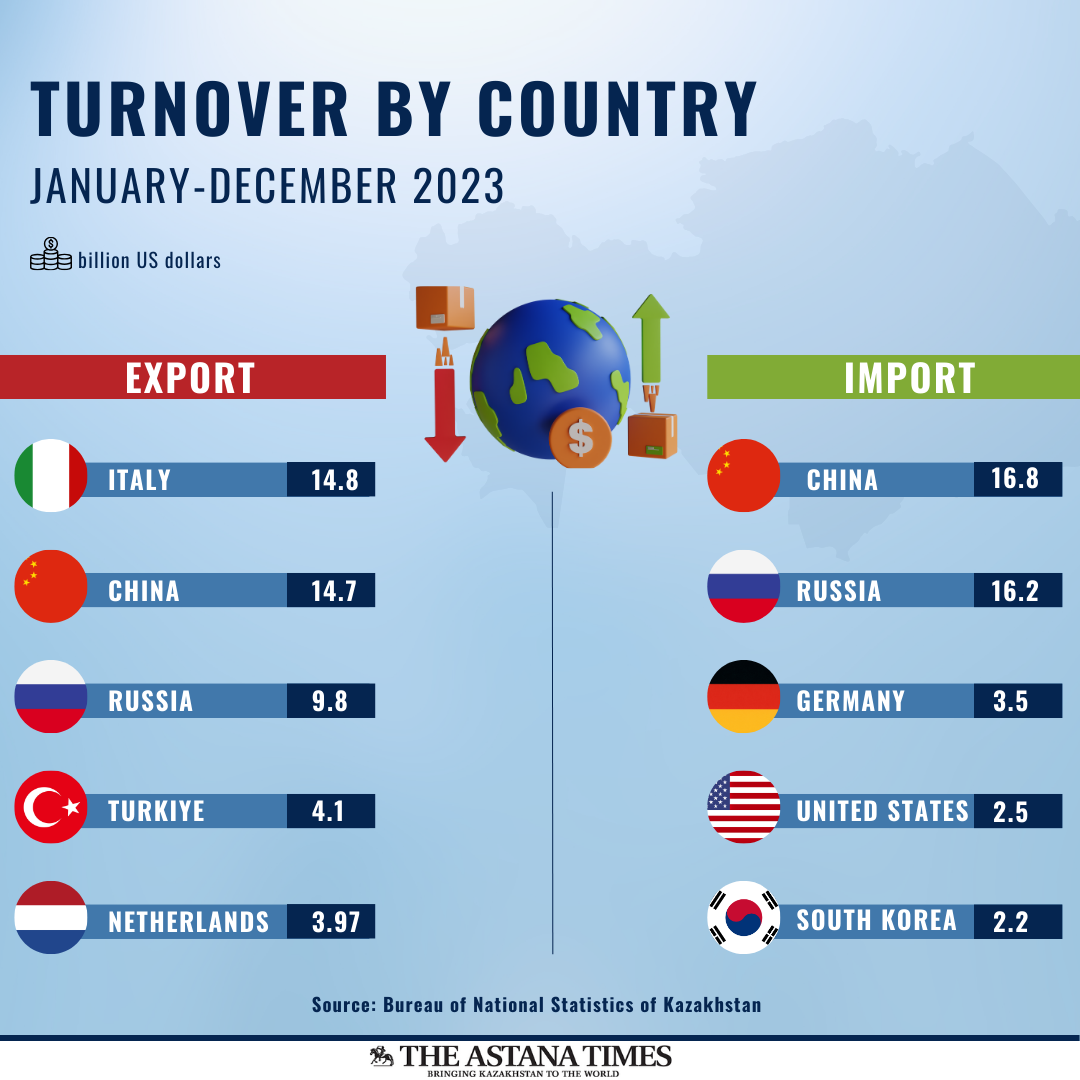

China has emerged as Kazakhstan’s top trading partner, with bilateral trade hitting $31.5 billion, marking an impressive 30% surge. Exports reached $14.7 billion, while imports reached $16.8 billion.

Photo credit: The Astana Times

“This shift was prompted by a simultaneous slowdown in trade growth with Russia and a significant increase in trade volumes with China,” noted Serik.

He observes the doubling of Chinese imports compared to 2021 across major product groups. In 2021, imports stood at $8.2 billion.

“Specifically, there has been a 3.5-fold increase in imports from China for light industry goods, a 2.2-fold increase for petrochemical products, a 1.7-fold increase for food products, a 5.3-fold increase for vehicles, and a 1.4-fold increase for machinery and equipment,” he explained.

However, this is not a limit for two countries. At a Central Asia-China summit in Xi’an in May 2023, President Tokayev set a target of $40 billion.

The official government data indicates Kazakhstan exports oil, copper and copper cathodes, copper ores and concentrates, natural gas, ferroalloys, uranium, and sunflower oil to China. Key imports include telephone equipment, computing machines, power generators, products made of ferrous metals, tires, parts and accessories for cars and tractors, road and construction machinery, and automobiles.

According to the Kazakh Ministry of Trade and Integration, there is a substantial demand for Kazakhstan’s agricultural products in China. China has also recently lifted its 19-year ban on imports of Kazakh poultry. It also lifted restrictions on the supply of meat and other agricultural products from the southeastern regions of Kazakhstan. Experts note these steps will likely support the upward trend in bilateral trade.

Key trade partners

In 2023, Russia became Kazakhstan’s second-largest trade partner, with bilateral trade hitting $26 billion, down from $27 billion in 2022.

Photo credit: The Astana Times

“Following the unstable situation in Russia, it was important for Kazakhstan to diversify not only its export streams but also its import streams, reducing dependence on traditional suppliers, particularly Russia. This trend underscores deep changes in the region’s geoeconomic landscape, where strategic partnership and economic mutual benefit become key drivers of international trade,” said Yernar Serik.

According to him, despite sanctions and economic challenges faced by Russia, the total trade volume between Kazakhstan and Russia in 2023 grew by 6% compared to 2021 ($24.6 billion), with exports to Russia increasing by 39% and imports decreasing by only 8%.

“Nevertheless, the import of Russian goods in certain categories significantly dropped, including machinery and equipment by 39%, vehicles by 38%, and pharmaceutical products by 36%, while supplies in other areas remained more stable. This contradicts the concerns of some experts that Russian goods, having lost European markets, could flood Kazakhstan’s market and harm local industry,” said Serik.

Kazakhstan’s key trade partners also include Italy ($16.1 billion), South Korea ($6 billion), Turkiye ($6 billion) and the Netherlands ($4.4 billion).

Italy is Kazakhstan’s largest exporter, accounting for 18.9% of exports. Exports to Italy reached $14.8 billion, up from $13.9 billion in 2022. These figures are expected to increase, considering the recent visit of President Tokayev to Italy and the signing of commercial agreements worth $1.5 billion.

Data from the bureau also indicates Kazakhstan’s trade with the European Union made $42.6 billion, accounting for nearly a third of the country’s foreign trade. Exports made $31.7 billion, while imports – $10.9 billion.

Kazakhstan’s exports and imports

Kazakhstan’s trade landscape is predominantly shaped by its rich natural resources, which form the backbone of its export economy. The country is a significant exporter of crude oil and oil products, alongside minerals such as refined and unprocessed copper, copper ores, and concentrates. It also plays a key role in the global market as a major supplier of uranium.

Kazakhstan has been taking steps to diversify its export base in an effort to decrease its dependency on the energy sector and enhance the overall competitiveness of its economy.

According to the data from the bureau, in 2023, 53.8% of Kazakhstan’s exports were crude oil and crude oil products, followed by radioactive chemical elements and isotopes, refined copper and unprocessed copper alloys, copper ores and concentrates, ferroalloys, and other gaseous hydrocarbons and petroleum gases.

On the import side, Kazakhstan largely imported cars and car parts, phone apparatus, pharmaceuticals, and parts and accessories for motor vehicles.

Surge in non-raw material exports to Asian countries

The government has a strategy in place to boost the country’s non-oil exports in a broader effort to move away from the commodity-based exports that have long supported its economic growth.

Kazakhstan has targeted boosting non-oil exports up to $41 billion by 2025. Their share in the country’s exports should reach 45.7% by 2025.

According to the data from the QazTrade Trade Policy Development Center, in 2023, non-oil exports hit $25.3 billion, accounting for nearly 32% of the total exports.

A notable trend for Kazakhstan in 2023 has been the substantial growth of its non-raw material exports to Asian countries. This includes a 10% increase in exports to China, a 34% rise in exports to Hong Kong, a 30% growth in exports to South Korea, and a remarkable 64% surge in exports to Vietnam. These figures not only highlight Kazakhstan’s expanding influence in Asia but also its efforts to diversify its export base beyond traditional raw materials.

Key non-oil exports include inorganic chemical products ($4.3 billion), including uranium; copper and its products ($3.2 billion), and equipment and mechanical devices ($1.8 billion),

Dynamic trade landscape

“The dynamics of Kazakhstan’s foreign trade relations exhibit significant shifts, with the main changes including a realignment towards China as a primary trade partner, largely due to increased imports from China and reduced supplies from Russia. These shifts, coupled with a record increase in imports and a decrease in export revenues, could significantly impact the country’s balance of payments and the stability of its national currency,” said Yernar Serik.

Another trend that he observes is a 21% growth in cargo transit through Kazakhstan, driven by a global redistribution of cargo flows.

“This increase in transit not only highlights Kazakhstan’s strategic geographical position but also opens up new opportunities for enhancing the country’s role in international logistics and trade, aiming for a fivefold increase in transit by 2029, as reported by the Ministry of Transport of Kazakhstan,” he said.

Kazakhstan’s foreign trade outcomes for 2023 paint a picture of a nation on the rise, aiming to navigate the complex circumstances of global commerce.