ASTANA – In just three years, Kazakhstan anticipates the introduction of the digital tenge to an economy already experiencing a surge in cashless payments. National Payment Corporation CEO Binur Zhalenov said the digital tenge is not merely a trend or hype but a necessity of the current time.

Binur Zhalenov addresses the meeting in Astana on Sept. 25. Photo credit: Assel Satubaldina/The Astana Times.

The digital tenge will be launched in three stages, concluding in 2025, with the initial phase rolling out in 2023.

“The introduction of the digital tenge is not for its own sake. We need it to be a useful instrument for ordinary Kazakh citizens and businesses,” said Zhalenov at a meet-up in Astana on Sept. 25, discussing the progress in the implementation of the digital tenge.

This project has been spearheaded by the National Bank of Kazakhstan (NBK) since 2021. Last year marked a significant milestone as the NBK concluded a comprehensive analysis conducted in collaboration with key stakeholders, such as financial market players, experts, and international financial institutions, to assess the necessity for the digital tenge’s introduction.

The digital tenge is a digital form of the Kazakh сurency that will be issued as a unique digital sequence (tokens) or electronic records stored on special electronic wallets. It will be regulated by the NBK.

Zhalenov stressed that the digital tenge is designed to complement, not replace, existing payment methods.

“In general, digital tenge should be perceived as smart money, which can be programmed and through which many services can be created,” said Zhalenov. “Digital tenge is the third form of money, along with cash and non cash. We do not intend to replace cash.”

Plans for 2023

In 2023, the focus is on two domains – pilot industrial operation and research and development (R&D), encompassing the swift commercialization of scenarios based on the digital tenge, testing of cross-border transactions and public procurement scenarios, and trialing advanced smart contracts of market participants and the stock exchange in a secure environment.

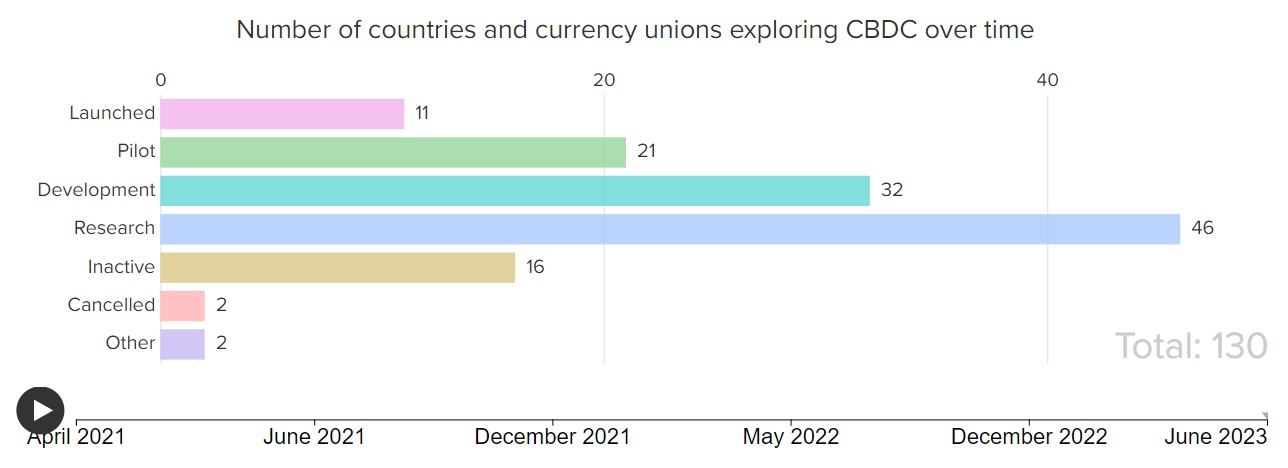

Number of countries exploring digital currencies is growing. Screenshot from the Atlantic Council tracker.

This year, they also plan to launch digital vouchers, a programmable payment.

“Consider, for instance, a school canteen. The state subsidizes free meals for pupils. The canteen is a private entity, there is a school that has a state budget, and there is a child who has this card. We build such a service that when the child comes to the canteen and swipes the card, the payment is automatically transferred from the school account to the canteen account. This process involves the smart contract of the digital tenge. The advantage lies in the complete automation of the entire settlement process, including reporting,” Zhalenov explained.

Given that the digital tenge represents a substantial shift in the payment system and in the structuring of relationships within the financial market, Zhalenov emphasized the importance of moving step by step “not to break what is already working well.”

By the end of this year, the National Payment Corporation will publish a paper that will describe in detail how the digital tenge platform is organized and the outcomes of pilot projects, including those that were unsuccessful.

“All this will be openly discussed so that we can actively develop it further,” he added.

The results of the work will also be presented at the Congress of Financiers in November in Almaty.

Distinct features

The digital currency boasts several advantages, according to Zhalenov.

It is expected to make cashless payments more accessible in places with limited internet access, increase the efficiency of spending public funds without compromising the anonymity of citizens, make cross-border and wholesale payments faster and cheaper, and provide the market with opportunities to create new products and business models.

Cross-border transactions often involve from eight to ten intermediaries and additional fees, he noted, but digital currency will allow direct transactions, reducing the number of intermediaries, increasing speed and decreasing costs.

The team is also working on a feature that will enable people to spend digital tenge from their cards, which Zhalenov referred to as interoperability.

“This is when digital tenge can be spent using a POS terminal, QR or NFC [near-field communication]. This year, we are working with Visa and Mastercard to introduce the interoperability service between digital tenge and their networks so that users will be able to spend digital tenge from their cards,” said Zhalenov.

Contrary to global public skepticism surrounding the government’s potential access to transactions that people make, Zhalenov said keeping the confidentiality of users is a top priority.

The team will implement essential security measures to safeguard against unauthorized access or surveillance of individual consumer transactions. Access to this information will be tightly controlled, and all transactions will be conducted in compliance with existing legislation.

Success depends on people

In its latest Sept. 18 report, the NBK stated that the value of the digital tenge would be directly proportional to the number of people and organizations utilizing it.

The rollout of the digital tenge should be as seamless as possible for people, Zhalenov said.

The implementation is also contingent upon what he described as the “synergy” between the central regulator and second-tier banks.

“It’s these entities that are attuned to the needs and responses of the clients and end-users. It is them who create the final products. Our task is to create an instrument, a so-called Lego block, to allow them to create useful products,” he said.

Global interest in digital currencies witnesses an unprecedented surge

Kazakhstan is not alone on this innovative journey. According to the American think tank, Atlantic Council, 130 nations, collectively representing a staggering 98% of the world’s gross domestic product (GDP), are now engaged in the exploration and development of national digital currencies. This is a significant upward trend compared to merely 35 countries in 2020.

Sixty-four of these nations are currently in advanced stages of research and development, including the creation, piloting, or even launching of digital currencies.

Zhalenov shared his optimistic outlook, believing that Kazakhstan has the potential to shape the discourse on digital currency globally.

“It is very important for Kazakhstan not to lag behind. We can shape global discourse on digital currencies, and by the time it is everywhere, it will be working successfully in our country,” he said.

Over the past few years, Kazakhstan has seen a tremendous increase in the use of digital technologies, largely driven by the pandemic. In their report, the Association of Financiers of Kazakhstan indicated that the volume of non-cash transactions in the first half of 2023 reached a record 63.1 trillion tenge ($131.1 billion), up by 40.8%, compared to 43.9 trillion tenge ($91.2 billion) in the same period last year.