ASTANA – The banking sectors in Armenia, Azerbaijan, Georgia, Kazakhstan, and Uzbekistan are expected to remain resilient in 2025, according to an S&P Global Ratings latest report on the banking sector of Central Asia and the Caucasus for 2025.

Photo credit: istockphoto.com

“Low double-digit lending growth and stable asset quality will support profitability and capital levels. Still, favorable economic growth prospects across the region, high lending demand, especially in the retail segment, sound funding and liquidity metrics, and stable capital buffers on the back of solid profitability will support ratings in 2025,” reads the report.

Experts note banks benefit from the “solid” GDP forecasts.

“Actual GDP growth in the region in 2024 outperformed our forecast. We forecast GDP growth in 2025 will be solid but less pronounced than in 2024. (…) Oil producers Kazakhstan and Azerbaijan benefit from recent oil price dynamics but face declining oil production. Positively, non-oil-related growth in these countries exceeds growth in the oil and gas sector,” write experts.

Risks

However, the report outlines several risks that could impact the banking sector, including rising geopolitical tensions, a global or regional economic slowdown, aggressive retail lending expansion, and rapid housing price increases that could create financial imbalances.

Experts noted that a potential resolution of the Russia-Ukraine war would have a limited impact on the region’s banking systems.

“The exact scope and timing of the possible ceasefire or any other solution to the war are difficult to estimate at this point,” reads the report.

The report also highlights emerging risks related to digitalization, artificial intelligence, climate change, and cyber threats, which experts say could present opportunities for banks that adapt proactively.

Kazakhstan’s banking resilience

The report found that Kazakh banks remain resilient despite a slowdown in lending growth and shifts in business models. High profitability and stable margins have allowed banks to accumulate financial buffers, mitigating risks in an uncertain environment.

In recent years, banks have relied on retail lending to drive profitability, though this has also increased their dependence on consumer demand.

“Retail loans comprised 60% of total loans at year-end 2024. Net interest margins have expanded by about 150 basis points since 2021 to an average of 6.4% in 2024,” reads the report.

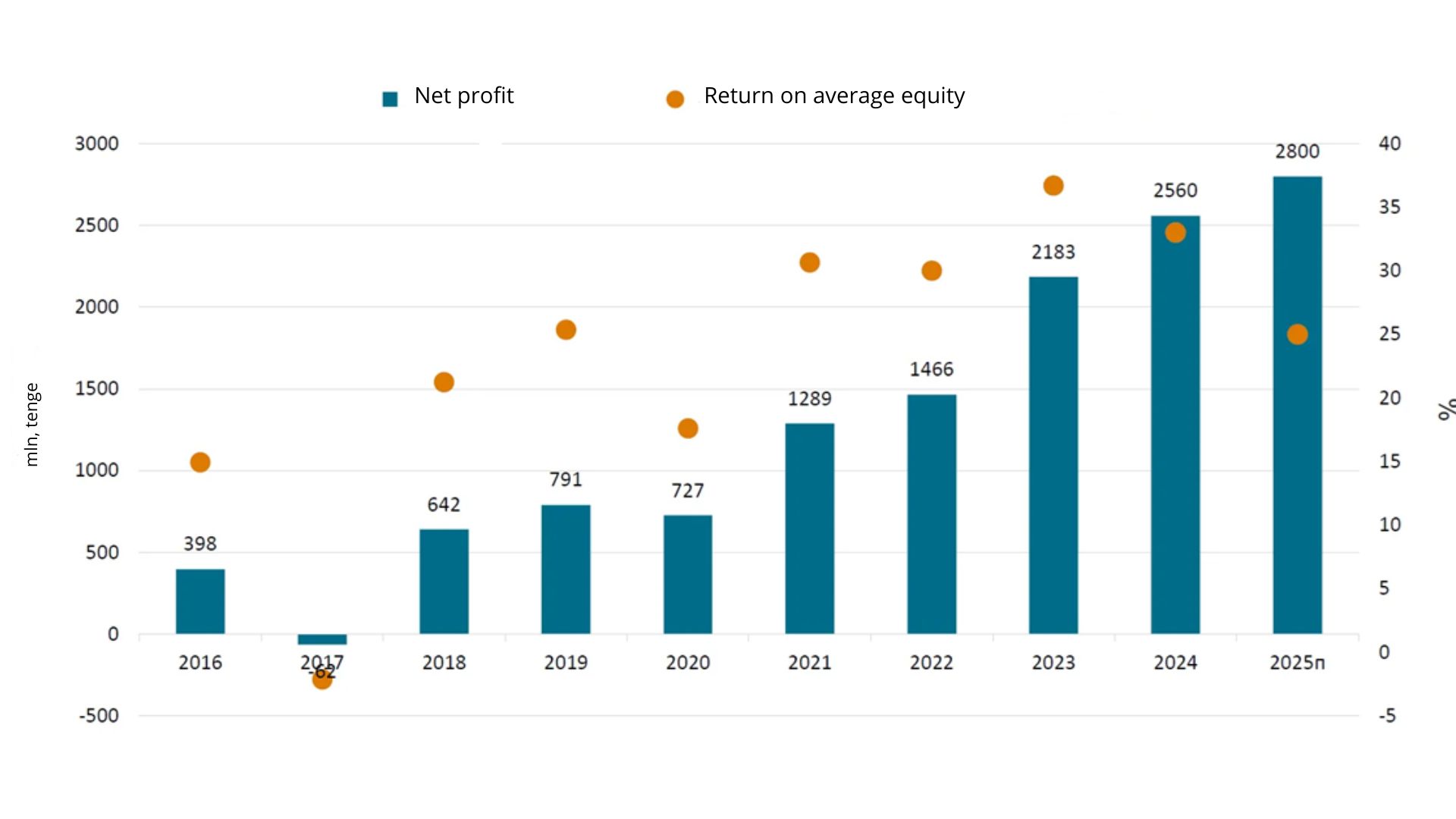

According to the experts, net income and return on equity in Kazakhstan will remain strong, though profitability has likely peaked. Photo credit: S&P Global Ratings report

While credit risk remains under control long-term, rising household debt among lower-income borrowers could lead to higher financing costs.

“While we expect retail growth will slow to 18%-20% in 2025, it will remain the major lending growth driver. Less aggressive growth will support banks’ risk profiles, while rapidly increasing indebtedness among less affluent households could increase banks’ credit costs during a credit cycle downturn,” it adds.

Financial supervision in Kazakhstan

Regulatory oversight of banking sectors in the region has evolved but remains less transparent and predictable compared to developed markets.

“In Kazakhstan, we have observed tangible measures over the past few years that point to a durable strengthening of the Kazakhstani financial regulator’s oversight and control framework,” reads the report.

“In Kazakhstan and Azerbaijan, regulatory oversight strengthened notably over the past few years. While we still consider that banking regulation and supervision in Georgia are the most advanced in the region, democratic backsliding in the country could impair banking sector regulation and the independence of the banking regulator,” it adds.

In 2024, S&P reviewed and upgraded Kazakhstan’s Banking Industry Country Risk Assessment (BICRA), a framework used to evaluate the risks faced by banks operating in specific countries.

S&P moved the country to group seven from group eight. The upgrade reflects improvements in financial supervision and oversight.

“The Kazakh banking sector has shown greater resilience to macroeconomic risks in recent years despite rising geopolitical uncertainty. Asset quality and financial indicators have significantly outperformed our initial projections,” analysts said.

Further improvements in BICRA assessments could positively impact the credit ratings of financial institutions in Kazakhstan.