ASTANA – In recent years, Kazakhstan has been experiencing rapid growth in the automotive industry. In 2023, the country produced over 148,000 cars, which is 30% more than a year earlier. One step at a time, economic diversification policy brings promising results in the development of the real economy.

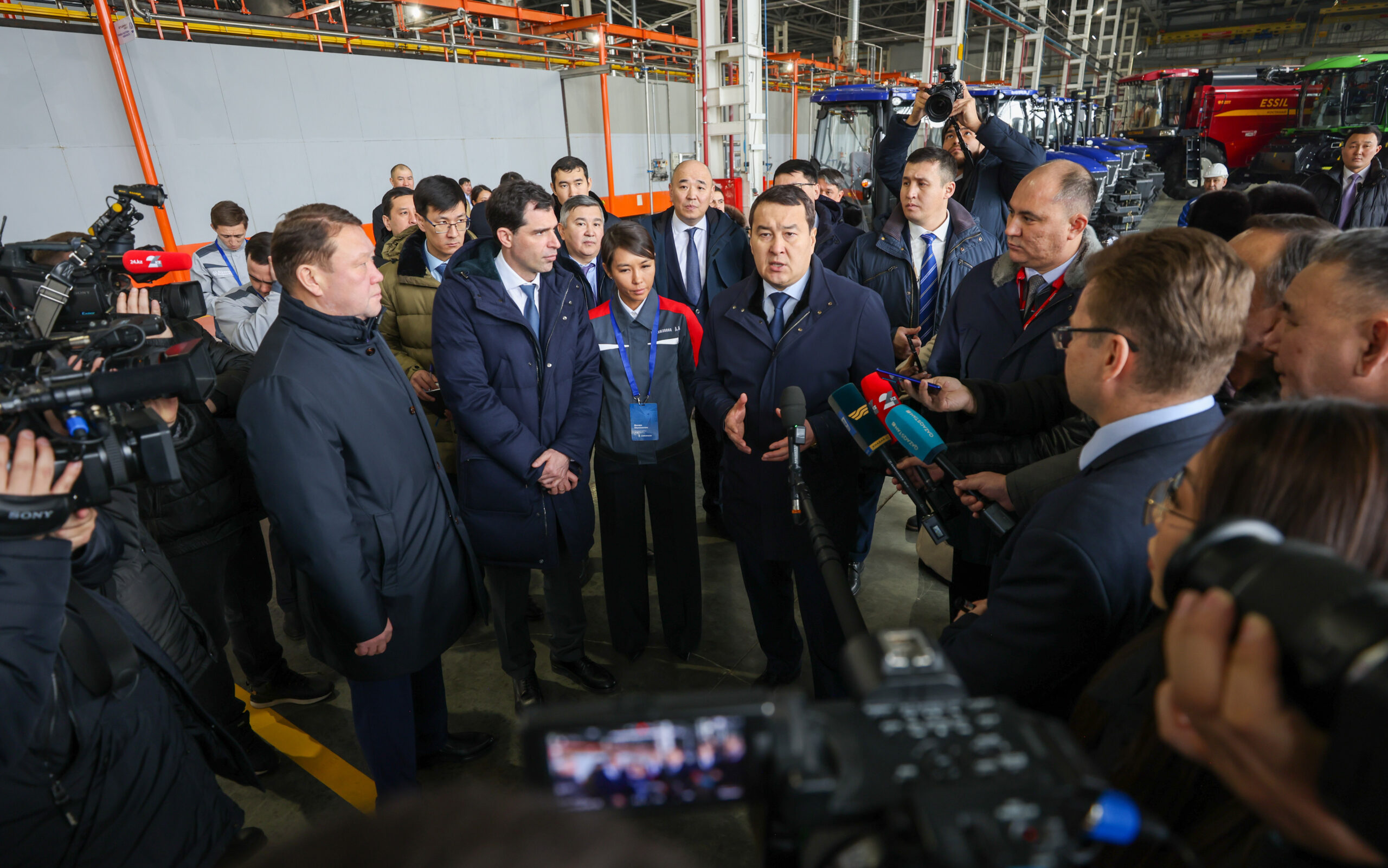

Last month, former Prime Minister Alikhan Smailov expressed support for the projects during his visit to the major machine-building facilities in the Kostanai Region. Photo credit: primeminister.kz.

Last year marked the 5.1% growth of the national economy. In the first 10 months of 2023, mechanical engineering grew by 27%. Among all of its sectors, the automotive industry demonstrated the highest increase at 42% for this period, according to the Kazakh Ministry of National Economy.

Automotive sector ramps up with the launch of new production facilities

The launch of new manufacturing plants is a major contribution to the industry’s dynamic development.

Back in 2005, KAMAZ, the Russian truck producer, became the first large manufacturer to enter the Kazakh market. In the following years, Kazakhstan began to be an attractive point for global players in the automotive industry.

Kazakhstan’s Allur and the U.S. General Motors agreed to on the possibility of updating and expanding the model range of cars in 2022. Photo credit: kapital.kz.

The automotive production ventures launched by South Korea’s Kia, Hyundai, and Daewoo, the U.S. Chevrolet, Italy’s IVECO, and China’s ANKAI are some examples of well-established cooperation with Kazakh partners.

The epicenter of Kazakhstan’s burgeoning automotive sector is the Kostanai Region in the north of the country. With its advantageous economic and geographical location, the region is home to the leading machine-building enterprises, including Allur, the largest automobile plant in Kazakhstan.

Allur remains the only company that produces all types of vehicles. Four years ago, it established cooperation with General Motors, the U.S. multinational motor-vehicle manufacturer. In 2022, the sides concluded an agreement in partnership with Uzbekistan’s UzAutoSanoat on the production of the new Chevrolet Onix using the completely knocked down (CKD) kits. The cost of the project was nearly 50$ million in investments.

Over 2,500 people work at the Allur machine-building factory. Photo credit allur.kz.

Last year, Skoda of the Volkswagen Group announced its readiness to re-enter the Kazakh market after partnering with Allur. In 2024, the Czech car manufacturer will begin the local assembly of the Kodiaq, Kamiq, Karoq, and its bestselling Octavia. The company plans to open 15 showrooms in Astana, Almaty, Shymkent and Kostanai.

The assembly of agricultural machinery is also thriving. Over the last year, Kazakhstan produced over 6,000 combine harvesters and tractors, which is 20% more than in 2022. Agromash Holding KZ, Allur’s subsidiary and the national producer of agricultural machinery and forage harvesters in Kazakhstan manufactures 1,000 combines, 3,000 tractors, nearly 300 seeders, and 200 pick-up platforms every year.

Another promising project in the Kostanai Region is the Kia automobile plant. It aims to produce nearly 70,000 cars per year and create 1,500 new jobs. At the outset, it plans to launch a small-scale production of three models: Sorento, Sportage, and Cerato. Upon completion of its construction by 2025, the plant will be the only Kia manufacturing facility operating in the Eurasian region.

In recent times, Kazakh consumers have shown a growing preference for Chinese cars. Astana Motors, Kazakhstan’s first company in car retail, service and assembly, announced the construction of a full-cycle multi-brand plant in the Almaty Industrial Zone for the annual production of 90,000 Chery, Changan, and Haval cars in cooperation with Chinese companies. The respective memorandum was signed with Chery Automobile Company, Changan International Corporation and Great Wall Motor in September 2022.

Responding to the growing customer demand in Central Asia, the Chinese premium electric automobile brand Zeekr arrived in Kazakhstan in September last year. Owned by Geely Automobile Holdings, the Chinese company agreed to cooperate with Orbis Auto, Kazakhstan’s vehicle distributor. It now offers the Zeekr 001 shooting-brake and Zeekr X sport-utility vehicle models.

The key event in Kazakhstan’s machine-building industry is the Kazakhstan Machinery Fair, organized by the Kazakh Ministry of Industry and Construction. With the purpose of strengthening the regional potential, the event allows Kazakh and foreign companies to showcase cutting-edge equipment and technologies for machinery and metalworking. This year, it will be held in Astana on April 24-26.

The highlight of the exhibition is the Forum of Machine Builders of Kazakhstan, a dialogue platform for the expansion of cooperation between government representatives and industrial entrepreneurs. The business program of the upcoming event includes over 30 panel discussions, conferences, and roundtables on machinery industry development, robotization and automation of production, state support measures, global trends, and international cooperation.

State measures for the development of the automotive sector

During the Kazakhstan-South Korea roundtable in August 2021, Kazakh President Kassym-Jomart Tokayev defined the automotive industry as “one of the catalysts of economic growth in Kazakhstan.”

For the comprehensive development of the automotive industry, the Kazakh government has been gradually introducing a set of measures.

Following foreign practices, Kazakhstan has enforced a mandatory recycling fee for imported vehicles. Since 2016, car manufacturers, official importers, and individuals seeking to import and register cars in Kazakhstan must comply with the requirement. The one-time payment has become essential for environmental purposes.

The policy of increasing localization is of particular importance for Kazakhstan. The level of localization ranges from 30% to 40%. The criteria for the assessment is the type of equipment. For instance, in case of small-node assembly, it can reach up to 50%.

In 2020, the country created a new stimulus – an agreement on the industrial assembly of motor vehicles. Previously, manufacturers provided welding and painting equipment to localize car models in Kazakhstan. Now, the government urges automakers to introduce domestic automotive components.

Automakers and other manufacturing enterprises are also provided with tax and customs benefits under special investment contracts.

In June 2019, Kazakhstan approved a roadmap for the development of mechanical engineering until 2024. The strategy covers all sub-sectors of mechanical engineering and contains a set of support measures, including tax preferences, financial and raw material support, as well as the provision of qualified personnel.

Overall, according to the Bureau of National Statistics, Kazakhstan has more than five million registered vehicles – 88% passenger cars, 9.9% trucks, and 2.1% buses.