ASTANA – The volume of cargo transportation along the Trans-Caspian International Transport Route (TITR), also known as the Middle Corridor, surged by 88% in the first nine months of 2023, reaching 2 million tons.

Photo credit: Axel Heimken/Getty Images.

In the first nine months of 2022, the figure stood at 1.1 million tons. The volume of cargo transportation along the route increased by 2.5 times to 1.5 million tons in 2022.

The corridor has emerged as a significant alternative to existing routes. Its total throughput capacity is 5.8 million tons of cargo annually.

The volume of container traffic was 33,000 twenty-foot equivalent (TEU) containers in 2022, while the current potential of the Middle Corridor is 80,000 TEU containers.

Overall, the transit time along the TITR was reduced from 38-53 days to 18–23 days. It is planned to reduce this period to 14–18 days in 2024, including within the territory of Kazakhstan – from 6 to 5 days.

Efforts to develop the Middle Corridor

Kazakhstan’s strategic goal is to increase the capacity of the Middle Corridor up to 10 million tons by 2030. To facilitate that effort, the country signed roadmaps with Azerbaijan, Georgia, and Turkiye to address bottlenecks and develop the Middle Corridor by 2027.

Kazakhstan Temir Zholy (KTZ) national railway company, Georgian Railway and Azerbaijan Railways inked an agreement to create a joint venture to develop multimodal service on the TITR on Oct. 26 in Tbilisi. A new company named Middle Corridor Multimodal was registered at the Astana International Financial Centre in November.

The company will provide services on a one-stop-shop basis, guarantee delivery times, and pursue a coordinated policy for developing multimodal service on the China – Europe/Türkiye – China route.

Efforts are ongoing to engage European transport and logistics companies. During the visit of German President Frank-Walter Steinmeier to Astana in June, the German company Rhenus and KTZ signed a memorandum of understanding for joint work to increase cargo flow on TITR.

The document envisions cooperation in developing logistics centers, and increasing the terminal capacities of the ports of Aktau and Kuryk.

In June, the Lithuanian company LTG Cargo joined the TITR International Association, opening new opportunities for diversifying cargo flows from Kazakhstan to Lithuania and vice versa.

Negotiations are underway between the Kazakh Ministry of Transport and Austria’s Rail Cargo Group for the company to join the TITR association and open a representative office in Kazakhstan.

Experts’ assessment

In its study published in May, the European Bank for Reconstruction and Development (EBRD) endorses the Central Trans-Caspian Network (CTCN), traversing through southern Kazakhstan, as the most sustainable option for forging links between Central Asia and Europe.

Plans to construct and upgrade extensive railway networks, including Khorgos dry port near the Chinese border, demonstrate a strong commitment to enhancing transit facilities.

EBRD estimates that approximately 18.5 billion euros ($20.4 billion) in investment is needed for these projects in Central Asia, highlighting their significant scale and potential impact. In a business-as-usual scenario, the transit container volume on CTCN could rise from 18,000 TEUs in 2022 to 130,000 TEUs in 2040.

With investment projects and measures for smoother connectivity in place, the transit container volume on the CTCN could surge to 865,000 TEUs by 2040.

Kazakhstan emerges as a hub in Eurasia

Positioned at the heart of the Eurasian continent, Kazakhstan is a crucial link for Asia-Europe transit traffic. The shortest routes from Europe to Central Asia, China, and Southeast Asia pass through the country.

Kazakhstan has invested $35 billion in the transport and logistics sector in the past 15 years. The nation boasts a network of transit, transcontinental corridors, and routes. Thirteen international corridors pass through Kazakhstan, including five railways and eight auto corridors.

In his Sept. 1 address, Tokayev tasked the government to bring the share of the transport and logistics sector’s contribution to the national GDP to 9% within the next three years. As of 2022, the figure stood at 6.2%, with a slight dip to 5.9% in the first half of 2023.

In February, the Kazakh government adopted the concept for the development of transport and logistics potential until 2030. The document provides a vision for the development of various transport modalities, including rail, road, maritime, and air, as well as logistics.

TITR, along with Northern Corridor, Southern Corridor, Central Asian Corridor, and North-South Corridor exemplify Kazakhstan’s commitment to enhancing regional connectivity. Each corridor serves as an important link for trade and transport, promoting economic growth not only in Kazakhstan but also in the connected regions.

Major infrastructure projects

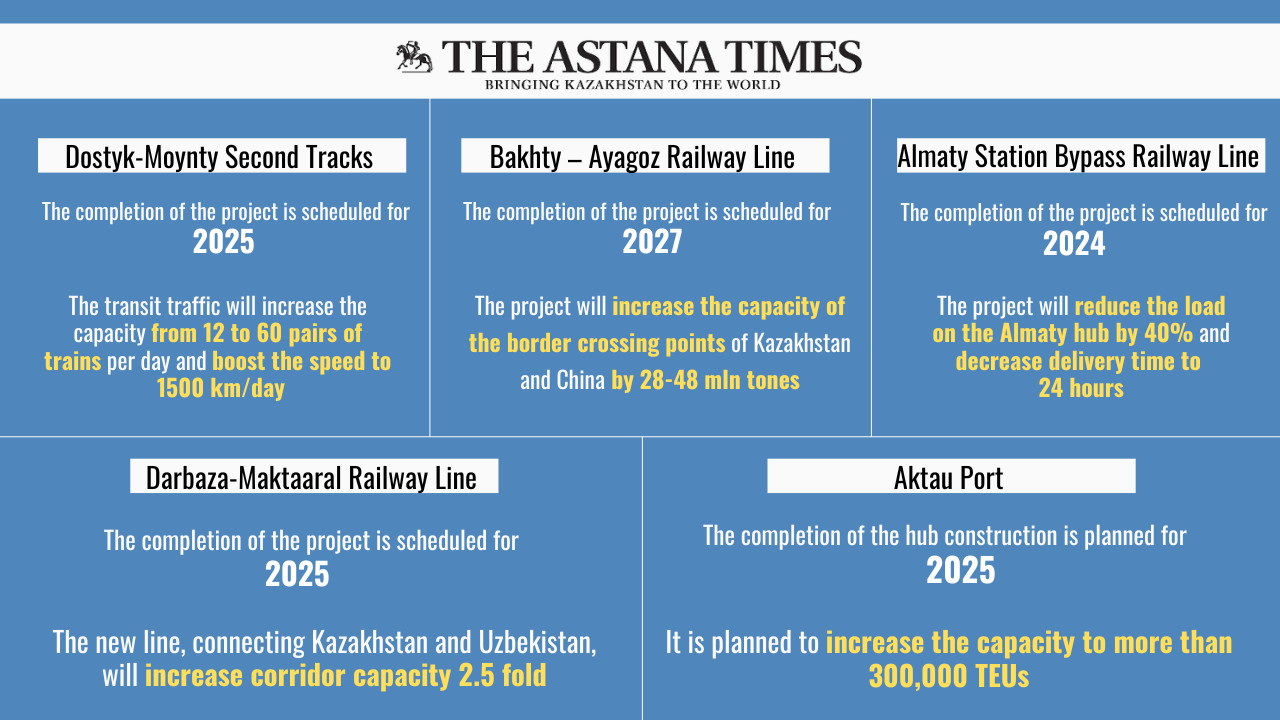

The construction of the second line at the 836-kilometer-long Dostyk-Moiynty section in the Karagandy Region began in November 2022. The completion of the project is scheduled for the fourth quarter of 2025.

The total cost of the project is estimated at 543 billion tenge ($1.18 billion). This project aims to enhance the volume of transit traffic between China and Europe. It includes increasing the capacity by up to five-fold from 12 to 60 pairs of trains per day and boosting the transportation speed to 1,500 kilometers a day from the current 800 kilometers a day.

Over the course of 20 years, this project is projected to boost budget revenues by $8.8 billion, contributing to a substantial overall economic impact.

On Dec. 21, the construction of a new 272-kilometer-long Bakhty-Ayagoz railway line began in the Abai Region. The completion of the project is scheduled for 2027.

The project is intended to unload two existing border railway stations at Dostyk-Alashankou and Khorgos-Altynkol, and increase the throughput capacity of the border crossing points of Kazakhstan and China from 28 to about 48 million tons.

The construction of the crossing and the railway line will cost over 320 billion tenge ($696.3 billion).

Another strategic project is the Almaty Station Bypass Railway Line, whose construction began on Nov. 14. The completion of the project is scheduled for 2024.

The project covers the construction of a new railway line between Zhetygen, 50 kilometers north of Almaty, and Kazybek Beka, 90 kilometers northwest of the city center. Projections suggest that the new line will reduce the load on the Almaty hub by 40%, reducing cargo delivery times to 24 hours.

The project has attracted private investments worth 93.6 billion tenge ($203.7 million).

The construction of a new railway line, Darbaza-Maktaaral, spanning 152 kilometers in length, commenced in the Turkistan Region on Nov. 27. The completion of the project is scheduled for 2025.

The objective of the new railway line linking Kazakhstan and Uzbekistan is to ease congestion at the Saryagash station, integrate the Maktaaral region into the main rail network, and improve transit connections to Iran, Afghanistan, Pakistan and India.

A new checkpoint will be established along the Kazakh-Uzbek state border as part of this initiative.

The cost of the project is estimated at 250 billion tenge ($543.9 million).

Aktau port

The development of the technical and economic justification for the construction of a container hub based on the Aktau port started in April. The financial details are almost finished, and the entire document, including the state examination approval, is expected to be ready by March-April 2024. The construction of the container hub is set to be finished in 2025.

Investments in the project amount to 13.7 billion tenge ($29.8 million).

The container handling capacity of the Aktau port is 70,000 TEUs. After upgrading the transshipment yard and equipment, it is expected to reach 120,000 TEUs. Once the container hub construction is finished, the capacity is expected to increase to more than 300,000 TEUs.

The construction of the container hub will enable the transportation of all types of cargo by containers. Non-ferrous metals are exported via the Aktau port. Containerization significantly shortens cargo handling time to just one day, compared to the four days it takes for transshipment onto a vessel, which can extend to a week, considering weather conditions.

Transit and cargo transportation dynamics

The significant increase in cargo transportation and transit, including container shipments, highlights the growing demand for Kazakhstan’s transit routes. According to the latest government data, in the first 10 months of 2023, the volume of freight traffic in Kazakhstan by all modes of transport reached 725.6 million tons.

Rail cargo transportation reached 246 million tons, an increase of 3% compared to the same period in 2022.

In 2022, rail cargo transportation between Kazakhstan and China surpassed 23 million tons and in 2023, this figure has increased by another 22%, said Minister of Transport Marat Karabayev at a Nov. 21 government meeting.

According to the minister, the railway has been meeting Kazakhstan’s export needs, with export shipments totaling 70.7 million tons, an 8.5% increase since the start of 2023.

Transit transportation increased by 19% from 2022 to 22.5 million tons in 2023. Kazakhstan aims to elevate transit cargo volumes to 35 million tons by 2029.

The total capacity of Aktau and Kuryk seaports is 21 million tons per year. Seaports have the possibility of transshipment of oil, grain, and general cargo and provide seamless ferry transportation of goods in wagons and motor vehicles. The merchant fleet consists of 20 vessels.

At a Dec. 12 government meeting, the minister said in the first 11 months of 2023, the volume of traffic through seaports reached 6.5 million tons, which is 10% more than in 2022.