NUR-SULTAN – Kazakhstan has entered the Global Green Finance Index 7 (GGFI), which measures the progress of green financial products across 124 international financial centers, according to the press service of the Astana International Financial Center (AIFC).

The Global Green Finance Index is launched by the London-based Z and Yen Group think tank and Finance Watch NGO.

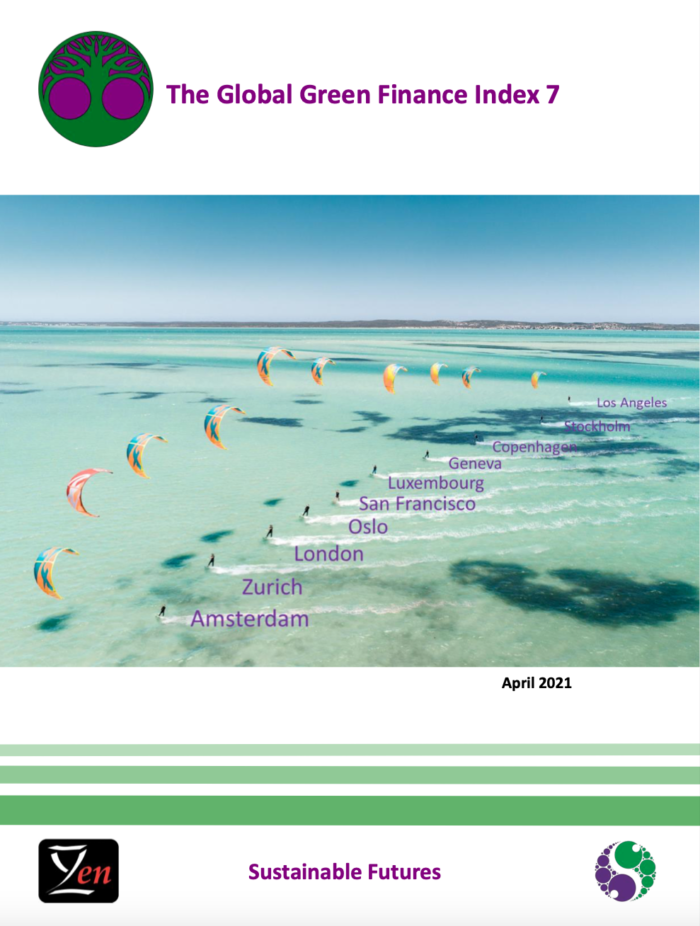

The GGFI was launched by the London-based Z and Yen Group think tank and Finance Watch NGO. This year, the authors researched 124 financial centers. The number of centers in the index has increased to 78 (from 74 in GGFI 6) with the addition of Busan, Nur-Sultan, Almaty, and Bahrain.

In his opening remarks, Andy Sloan, a Chair of the Guernsey Green Finance, noted that the index will encourage and inspire other financial centers to channel capital flows to the areas of greatest need, and empower strategic action.

Nur-Sultan and Almaty have joined the index at the top of the Eastern Europe and Central Asia region. Nur-Sultan ranks 57th in the world and Almaty ranks 62nd along with Liechtenstein, Jakarta and Cape Town.

“Entering the GGFI index, moreover, being at the front of the line among Eastern Europe and Central Asia, is an important milestone for the AIFC, meaning that the financial center is moving in the right direction. The financial system and country’s economy are systematically moving towards sustainable development, and the AIFC will continue to promote progress in this direction,” said AIFC Governor Kairat Kelimbetov.

The AIFC established the Green Finance Center in 2018. The center implements sustainable financial tools and attracts investments into environmental and social projects in Kazakhstan and Central Asia.

Also, the Green Finance Center has introduced definitions for green finance and green taxonomy, a classifier of economic activities and projects that meet technical selection criteria according to national environmental legislation. The new legislation provides incentives for entrepreneurs who use green finance instruments. Businesses engaged in renewable energy, waste management, energy efficiency, smart lighting, energy saving services – and many other sectors according to the Green Taxonomy – will be entitled to a 50 percent discount on coupon and loan rates.

The green bond market was launched at the AIFC Exchange in August of 2020, reported the press service of the AIFC. This will help open a new segment of the exchange – the stable bond market in the future.

Kazakhstan’s Damu Entrepreneurship Development Fund became the first issuer of green bonds. In April, the fund was recognized by the sixth Annual Climate Bonds Awards 2021 and received the Green Market Pioneer award for the first ever issuance of “green bonds”.