ASTANA — New regulations reshaped Kazakhstan’s housing market in 2025, pushing demand beyond major cities toward regional centers as prices rose faster than inflation, according to experts.

Collage is created by The Astana Times.

Prices per square meter increased 15.7% year-on-year in the primary market and 14.6% in the secondary market, driven by tighter rules for developers, anticipated tax changes, rising pension fund withdrawals for housing, and sustained inflationary pressure, according to Halyk Research. The Astana Times breaks down the key trends shaping the market and what buyers and investors can expect in 2026.

Price dynamics: big cities cool, regional centers gain momentum

According to Halyk Research, price growth in 2025 significantly accelerated compared to 2024, particularly in the primary and secondary markets, where annual growth rates increased fivefold and 3.5 times, respectively.

In the primary housing segment, the fastest growth was recorded in Konaev, in the southeastern part of the country, and in Pavlodar, in the north, where prices jumped 22.9% year-on-year, driven largely by a sharp increase in December. In the secondary market, Almaty led the country, with prices rising 25.4% year-on-year, while Konaev saw no change from 2024.

The slowest growth was recorded in Karagandy, at just 2.4%. Rental prices also outpaced inflation, increasing 13.1% year-on-year nationwide. The most pronounced rent growth was seen in Pavlodar (42.9%), Petropavl (40.9%), and Aktobe (30.4%).

Financial consultant Diana Alzhan, author of the educational program A Woman with an Apartment and Money. Photo credit: thevoicemedia.kz

Financial consultant Diana Alzhan, author of the educational program A Woman with an Apartment and Money, noted that Almaty’s market is showing signs of saturation.

“In Almaty, price growth, both for property and rent, is slowing because the market is already overheated. At the same time, the trend of relocating to calmer, smaller cities is gaining momentum,” she told The Astana Times.

According to Alzhan, migration to major cities is no longer accelerating as it once did. “I see the trend of moving to large cities cooling down. People are choosing regional cities where life is more compact, commuting is faster, and there are no traffic jams,” she added.

Alzhan also highlighted diverging demographic trends between Kazakhstan’s two largest cities.

“The inflow of people into Almaty has slowed, while Astana continues to attract newcomers. Statistically, Astana’s population is expected to reach Almaty’s level within the next three years. Everything that is being built will find demand, and prices will hold if not rise,” she said.

Number of deals: seasonal surge, moderate annual growth

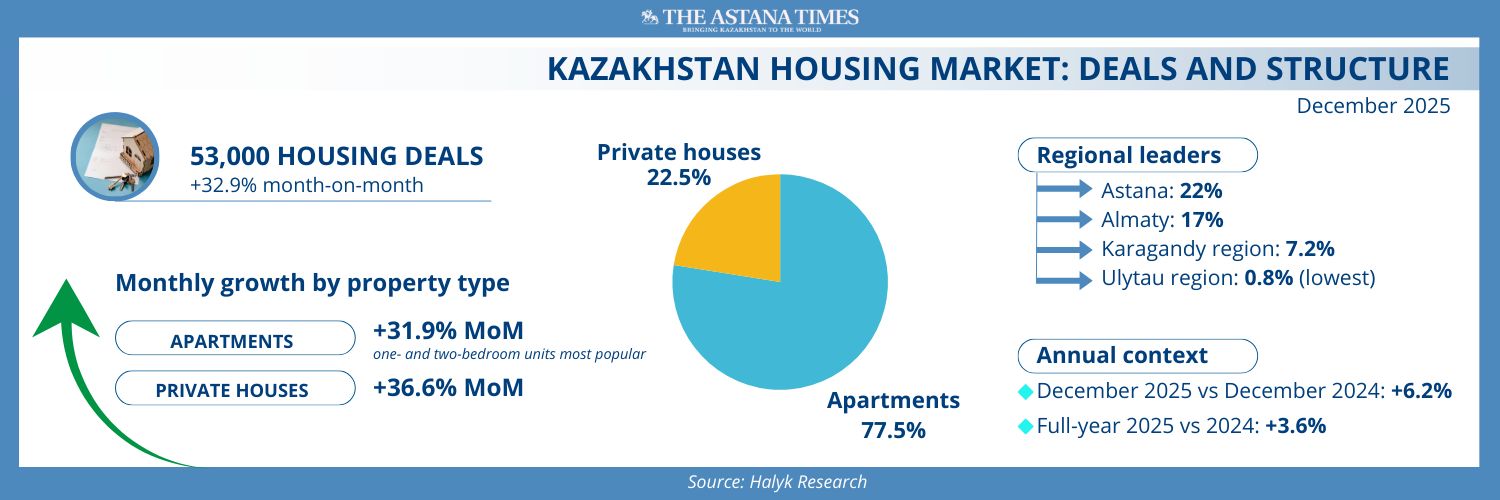

In December 2025, Kazakhstan’s real estate market followed a familiar seasonal pattern, recording a sharp rise in transactions. A total of 53,000 housing purchase-and-sale transactions were registered, marking a 32.9% increase compared to November. Apartments in multi-unit buildings accounted for 77.5% of all deals, while 22.5% involved private houses. The highest transaction activity was recorded in Astana (22%) and Almaty (17%), followed by the Karagandy region (7.2%), whereas the Ulytau region again posted the lowest share at 0.8%.

Apartment sales rose 31.9% month-on-month, with one- and two-bedroom units remaining the most in demand, while transactions involving private houses increased even more sharply, by 36.6%. On a yearly basis, the market demonstrated moderate growth, with the number of deals in December 2025 up 6.2% compared to December 2024, and total transaction volume for 2025 exceeding 2024 levels by 3.6%.

Outlook for 2026: growth continues, but at a slower pace

Arslan Aronov, analyst at Halyk Research, expects the market to remain in growth territory in 2026, though with more moderate dynamics.

“Housing demand is likely to slow due to tax changes, tighter mortgage conditions, and higher minimum sufficiency thresholds under the Unified National Pension Fund, which may limit market activity this year,” Aronov writes.

He also pointed to the new Construction Code, signed by President Kassym-Jomart Tokayev on Jan. 9, and set to take effect on July 1.

“Stricter requirements for developers and enhanced oversight could raise housing costs and dampen demand in the short term. However, in the long run, this will improve housing safety and strengthen the protection of citizens’ rights,” Aronov noted.

Looking ahead, Aronov expects deal volumes to decline in early 2026.

“From Jan. 1, 2026, the minimum sufficiency threshold was raised, which may restrain Unified National Pension Fund withdrawals and slow price growth. The most noticeable impact will likely be in the primary housing segment. Tax changes and tighter mortgage conditions will also partially curb market activity,” he said.

Expert advice: housing will get harder to access

Alzhan, who works closely with individuals planning their first purchase, warns that housing affordability will continue to decline.

“In my view, Kazakhstan is moving toward a European-style model where mortgages are accessible to very few. The circle is narrowing, the screws are tightening, and people will need to put in far more effort to buy a home, especially young people,” she said.

For now, Otbasy Bank, a house construction savings bank, remains the most accessible option for buyers. While recent banking reforms allow other banks to adopt housing savings systems, Alzhan is skeptical about their long-term commitment.

“This system isn’t simple. It works because depositors finance future loans. Other banks may try it commercially, but most will likely abandon it. Otbasy Bank will remain the key player,” she said.

Alzhan expects rental prices to keep rising and notes a return to shared living arrangements.

“Renting an entire apartment alone is becoming economically unviable again. We’re seeing more people, both in large and small cities, choosing to live together as families or groups,” she said.

She added that if inflation remains high, Kazakhstan may gradually move toward a rental culture similar to Western countries.

“In the United States and Europe, renting is deeply ingrained. Owning a home there is a major privilege,” she noted.

Greater discipline is key

Despite rising prices, Alzhan stresses that buying a home in Kazakhstan is still possible but with discipline. She observed that women are often the primary drivers of housing decisions, even within families. One of the most common mistakes, she said, is psychological.

“For years, many women haven’t allowed themselves to believe they can buy a home at all. In reality, mortgage options always exist and always will,” she said.

Another frequent error is failing to save for a down payment.

“Even if someone doesn’t fully believe it is possible yet, they still need to save whatever they can. Step by step,” she explained.

When expenses leave no room for savings, the focus should shift to income growth.

“Everyone thinks about how to cut expenses, but very few seriously think about how to increase income. Those who set that goal usually achieve it,” Alzhan said.