ASTANA— The International Monetary Fund (IMF) projects Kazakhstan’s economic growth to stabilize at approximately 3.5% in the medium term, with inflation expected to ease further and reach its 5% target by 2028, according to a Jan. 31 IMF press release.

Astana. Photo credit: Shutterstock

This assessment follows the IMF Executive Board’s conclusion of the 2024 Article IV consultation with Kazakhstan on Nov. 27 last year, conducted on a lapse-of-time basis.

Economic performance in 2024 and upcoming risks

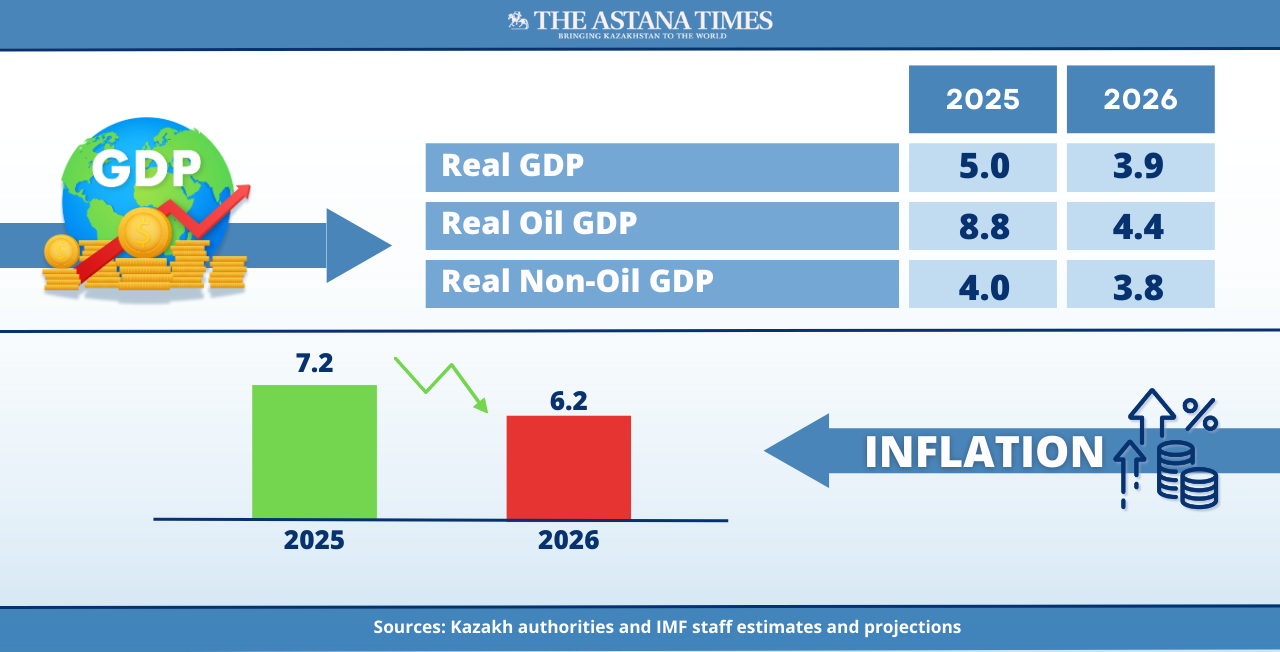

Kazakhstan’s economic performance in 2024 remained robust, continuing the momentum of 5.1% growth in 2023. Economic activity picked up in the second half of the year, leading to a projected 3.9% annual growth rate. Inflation, however, remained elevated at an estimated 8.2%, slowing at a more gradual pace than expected due to rising domestic energy tariffs and an expansionary fiscal policy. On the external front, the IMF noted that Kazakhstan’s current account deficit is expected to be moderate in 2024, with the country’s external position assessed as moderately weaker than what is implied by economic fundamentals and desirable policies.

The IMF underscored several risks to Kazakhstan’s economic outlook, which remain tilted to the downside. External risks include a potential slowdown in major economies, heightened regional conflicts, secondary sanctions, and increased volatility in commodity prices or disruptions to export pipelines. Domestically, risks stem from delays in large infrastructure projects, continued fiscal underperformance that could exacerbate inflationary pressures, and a resurgence of social tensions. At the same time, upside risks exist, such as accelerated reform implementation, higher oil prices, and stronger foreign investment in new sectors.

The IMF’s assessment emphasized the need for a tight monetary policy until inflation approaches its target level. The combination of strong economic growth, a slower pace of disinflation, and an uncertain global outlook warrants continued monetary policy prudence. To enhance the effectiveness of monetary policy, the IMF recommended further strengthening the institutional independence and governance of the National Bank of Kazakhstan (NBK). It also advised that the NBK refrain from foreign exchange interventions unless market conditions become disorderly.

Challenges in fiscal policy and revenue collection

Fiscal policy continues to face significant challenges due to recurrent underperformance. As of September last year, tax revenues had reached only 60.5% of the budget plan, reflecting an expansionary fiscal stance. The IMF called for measures to avoid fiscal pro-cyclicality and strengthen the overall fiscal policy framework. These efforts would support the authorities’ goal of fiscal consolidation while maintaining a balanced external position.

Key priorities include improving macro-fiscal forecasting, strengthening budget planning, and leveraging new tax and budget codes to enhance non-oil revenue mobilization through a gradual increase in VAT rates and greater efficiency in public spending. Fiscal policy effectiveness also depends on improving public sector data transparency and aligning it with international standards, reducing off-budget expenditures, and limiting discretionary transfers from the National Fund.

The IMF acknowledged the resilience of Kazakhstan’s banking sector and noted the rapid progress made in implementing the 2023 Financial Sector Assessment Program (FSAP) recommendations. The institutional independence of the Agency for Regulation and Development of the Financial Market (ARDFM) has been significantly reinforced, along with improvements in risk-based supervision.

Additionally, the NBK’s macroprudential policy framework has been expanded. The IMF stressed the importance of introducing a fully-fledged bank resolution framework to enhance coordination among the ARDFM, the NBK, and relevant ministries.

Reducing state influence in the economy and climate change risks

Implementing structural reforms remains critical for Kazakhstan’s long-term economic growth. The IMF noted that achieving the government’s ambitious growth targets requires reducing the state’s footprint in the economy and fostering competition and private sector development. However, recent trends indicate increased state interventions, subsidies, the expansion of state-owned enterprises, and external restrictions. The IMF recommended stronger public governance to enhance economic resilience and diversification, including sustained efforts to address corruption-related vulnerabilities.

Given the growing impact of climate change, the IMF highlighted the need for Kazakhstan to accelerate its transition to a more sustainable and resilient economic model. While the country has made progress in implementing its national strategy for carbon neutrality, further measures are needed to modernize energy infrastructure, enhance energy efficiency, and reform fossil fuel subsidies. Additionally, the IMF emphasized the importance of policies aimed at transforming high-emission sectors, managing climate-related risks in the financial sector, and ensuring that vulnerable populations are protected during this transition.