ASTANA – Kazakhstan’s proximity to Russia, China, Central Asia, and the Caspian region strengthens its role as a key gas exporter. The nation’s traditional export markets are the CIS, but as Europe seeks alternatives to Russian gas, demand for Kazakh gas in Europe is growing. Despite this, China remains the country’s largest gas export market.

Gas industry of Kazakhstan. Photo credit: eurasian-research.org

In 2023, Kazakhstan exported 5.3 billion cubic meters of natural gas, an 8% increase from 2022, when gas exports totaled 4.6 billion cubic meters, meeting 85.1% of the year’s target. The decrease in overall gas exports has allowed for more supply in the domestic market. In 2021, total gas exports were 16 billion cubic meters, down 19.2% from 2020.

China has been the main consumer of Kazakh gas in recent years. In 2023, Kazakhstan supplied 5.857 billion cubic meters to China, marking a 15.5% increase over the 5.07 billion cubic meters in 2022. Deliveries to China in 2021 reached 5.6 billion cubic meters, compared to 7.37 billion cubic meters in 2020.

From January to August 2023, gas exports from Kazakhstan to Russia reached 3.6 billion cubic meters, down from 7.9 billion cubic meters in 2022, which represented a 2.7% decrease compared to the previous year. In 2021, Russia received 8.2 billion cubic meters, while 2020 saw nine billion cubic meters. One of the highest export levels was in 2017, with 14.7 billion cubic meters.

Kazakhstan’s gas exports to Uzbekistan peaked in 2017 at 1.5 billion cubic meters but fell to 400 million cubic meters in 2019 and 100 million cubic meters in 2020. No exports were recorded to Uzbekistan in 2021 or 2022.

In 2023, Kazakh suppliers were unable to enter the Ukrainian market, just as they had in 2021. In 2022, Kazakhstan exported 108.4 million cubic meters of gas to Ukraine, generating a profit of $13.546 million. In 2020, gas exports to Ukraine reached 600 million cubic meters.

Gas exports to non-CIS countries saw significant growth in 2019, with Kazakhstan’s gas exports reaching 7.4 billion cubic meters. In 2020, exports remained steady at 7.4 billion cubic meters, with Switzerland accounting for 3.2 billion cubic meters. However, 2021 saw a decline in exports to 6.4 billion cubic meters, which was still higher than 2022, when exports dropped to 5.1 billion cubic meters.

Kazakhstan ranks 22nd globally and third among CIS nations in gas reserves, after Russia and Turkmenistan.

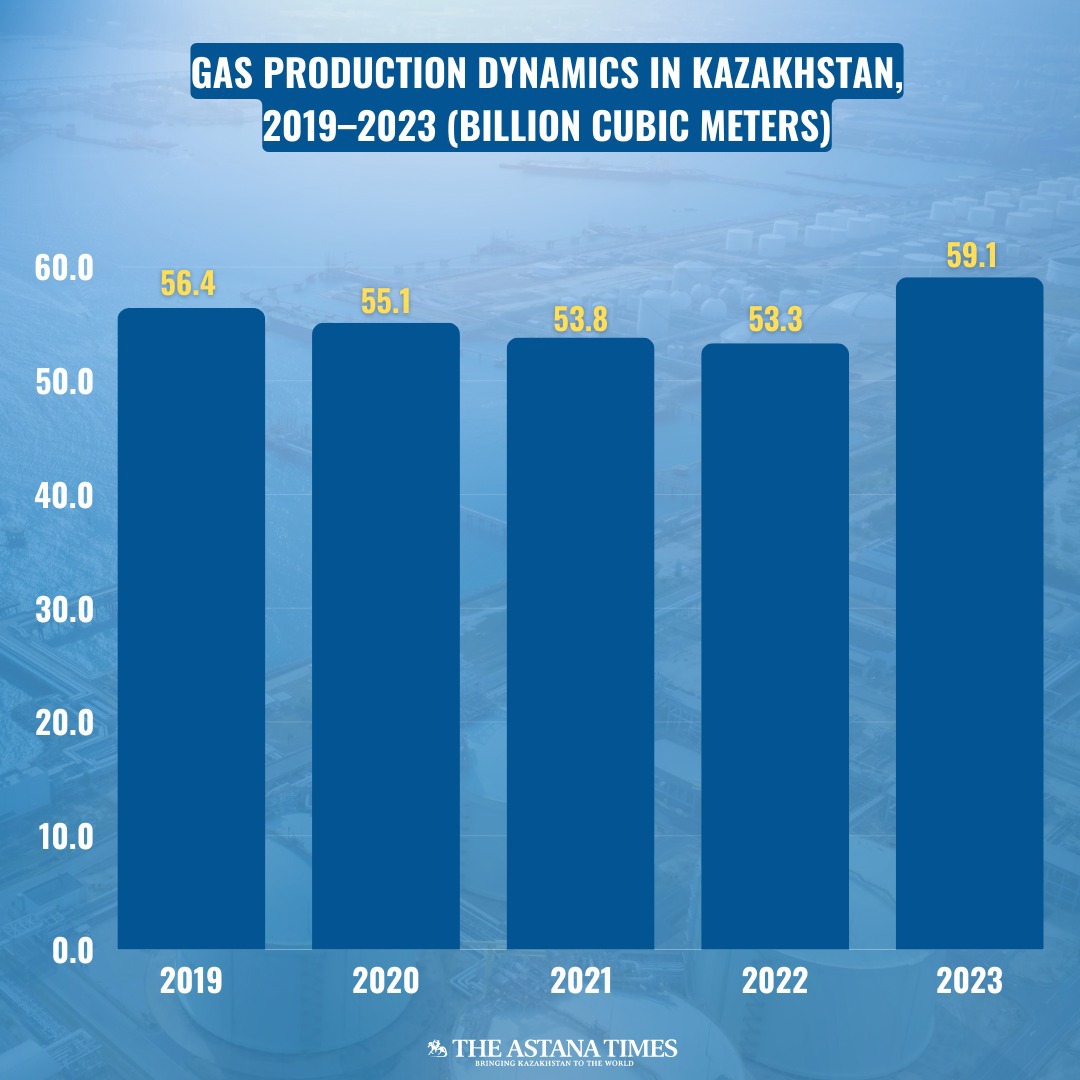

Kazakhstan’s 2024 gas production target is 60.5 billion cubic meters, a 2.3% increase over 2023’s output of 59.1 billion cubic meters, with production expected to reach 91 billion cubic meters by 2030. 2022 production totaled 53.3 billion cubic meters, exceeding the target by 3.1%. Marketable gas—processed and purified gas ready for sale—reached 27.8 billion cubic meters, or 94% of the 2022 plan. In 2021, output was 53.8 billion cubic meters, a 2.3% decline from 2020, which saw production at 55.1 billion cubic meters, over seven times higher than 1991’s level of 7.9 billion cubic meters.

In 2023, marketable gas totaled 29.8 billion cubic meters. Production reached 14.9 billion cubic meters by mid-year, meeting 50% of the annual target. The primary growth in gas production is anticipated to come from major fields such as Karachaganak, Tengiz, and Kashagan.

Kazakhstan hosts approximately 79 gas production companies, including 23 that sell gas into the gas transmission system to meet the needs of the domestic market and for export.

Kazakhstan’s role in Central Asia’s gas landscape

The country is also a major gas transit hub in Central Asia, facilitating gas transport from Turkmenistan and Uzbekistan to China and Russia. Uzbekistan’s gas shortages have allowed Kazakhstan to increase its transit volumes and revenue. In 2023, Kazakhstan transported 1.28 billion cubic meters to Uzbekistan, with plans to raise this to 11 billion cubic meters.

According to oil and gas expert Abzal Narymbetov, demand for transit gas is expected to grow. Initially, the Central Asia-Center pipeline supplied Uzbekistan’s gas to Russia and Europe, but Uzbekistan’s recent shortages led to an unprecedented decision to buy Russian gas.

“In the first quarter alone, Uzbekistan signed a $320 million deal with Gazprom, and I expect this trend to grow as Uzbekistan’s electricity sector, reliant on gas for 85% of its needs, continues to face rising demand. In this situation, Kazakhstan gains the opportunity to receive income from transit fees,” Narymbetov told Kazinform news agency.

The transition to gas power has left Uzbekistan facing shortages, with production falling from 51.7 billion cubic meters in 2022 to 46.7 billion cubic meters last year. Meanwhile, Kazakhstan seeks to maintain its transit revenue by updating and modernizing the Central Asia-Center gas pipeline.

A recent agreement between QazaqGaz national company and Turkmengaz enables Kazakhstan to transit and sell Turkmen gas, which will benefit domestic demand and export obligations. Turkmenistan’s 27.4 trillion cubic meters reserves represent a significant opportunity for Kazakhstan. The country also sees potential in the Turkmenistan-Afghanistan-Pakistan-India (TAPI) pipeline project, which could expand its export market while addressing local shortages.

Kazakhstan’s transit of Turkmen and Uzbek gas to China is expected to increase to 37.1 billion cubic meters this year, up by 1.5 billion cubic meters from last year. Discussions are underway to raise Russian gas transit to the Kyrgyz Republic.

Strengthening gas capacity

Talks are also underway to boost gas exports to China, including the potential construction of a new pipeline to increase capacity.

In 2018, Kazakhstan agreed to supply China with 10 billion cubic meters annually for five years. However, meeting this goal has been challenging. Exports were 4.4 billion cubic meters in 2022 and 5.8 billion in 2023. Due to winter shortages, Kazakhstan sometimes halts exports to prioritize domestic needs.

Kazakhstan’s gas production primarily involves associated petroleum gas, which requires refinement before export. With only two processing plants, Kazakhstan cannot meet both export obligations and local demand, so raw gas is sent to Russia for refining.

President Kassym-Jomart Tokayev in his state-of-the-nation address called for accelerating construction of new processing facilities in Zhanaozen, Kashagan, and Karachaganak, underscoring the importance of attracting investment.

At a government meeting on July 16, Energy Minister Almassadam Satkaliyev announced plans for new processing plants, including interest from Qatari investors.

From 2026 to 2030, four new plants are planned, including two at Kashagan with capacities of one billion and 2.5 billion cubic meters, a four-billion-cubic-meter plant at Karachaganak, and a 900-million-cubic-meter plant in Zhanaozen.

Strategic expansion

Despite capacity constraints, Kazakhstan remains committed to supplying gas to China. After a presidential visit to Beijing, QazaqGaz national company expanded its agreement with PetroChina until 2026.

QazaqGaz national company, in collaboration with Chevron Corporation and its subsidiary Chevron Munaigas Inc., signed a contract for potential geological exploration at the Zhalibek site in the Aktobe Region.

A crucial component of sustaining these exports is the expansion of the Beineu-Bozoi-Shymkent pipeline, which supplies the Central Asia-China pipeline. This route has a capacity of 15 billion cubic meters annually, compared to Russia’s Power of Siberia pipeline, which can handle 38 billion cubic meters. Kazakhstan plans to build a second line for the Beineu-Bozoi-Shymkent pipeline to boost capacity by 2026-2027.

Customs data show that gas exports to China generated $1.467 billion last year, with Kazakhstan’s average price at $250.43 per thousand cubic meters, slightly undercutting Russia’s $257 rate. While unable to match Russia’s volume, Kazakhstan’s pricing strategy makes it competitive. Russia plans to lower its price for China to $227.8 by 2027, intensifying the market.

The Power of Siberia pipeline is the main gas artery from Russia to China, transporting 22.7 billion cubic meters last year. Plans for the Power of Siberia-2 pipeline could further challenge Kazakh exports.

Kazakhstan has considered a pipeline through its territory to meet the northern demand of two billion cubic meters per year, but Russia chose Mongolia for the transit route.

In July, Satkaliyev announced that Russia could supply gas to the North Kazakhstan and East Kazakhstan regions.

“The Ministry of Energy is evaluating two options for gasifying the northern and eastern regions. The first option is to extend gas service to the Akmola and North Kazakhstan Regions by advancing the second and third stages of the Saryarka gas pipeline, contingent on completing the second line of the Beineu-Bozoi-Shymkent pipeline. A feasibility study is currently underway for this joint project. The second option involves supplying gas directly from Russia,” he said.

The article was originally published in Kazinform.